Question: Group Assignment Questions Due Date : 2 4 April 2 0 2 4 Moleng Ltd is considering two investment projects, each of which requires an

Group Assignment Questions Due Date : April

Moleng Ltd is considering two investment projects, each of which requires an upfront expenditure of Pmillion. The riskfree debt has an expected return of The slope of the characteristic line that describes the relationship between excess returns for project and those of the market portfolio is The return on the market portfolio is The project will produce the following aftertax cash flows in million Pula:

tableYearProject UProject V

a What is the discounted payback period for each of the project?

b Briefly explain any two demerits of discounted payback period.

Group Assignment Questions Cont's

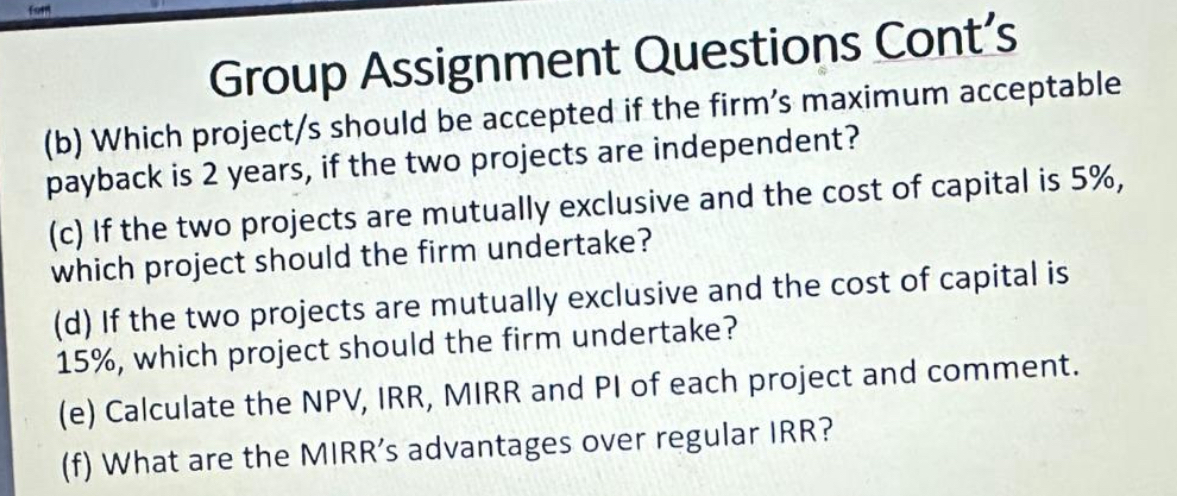

b Which projects should be accepted if the firm's maximum acceptable payback is years, if the two projects are independent?

c If the two projects are mutually exclusive and the cost of capital is which project should the firm undertake?

d If the two projects are mutually exclusive and the cost of capital is which project should the firm undertake?

e Calculate the NPV IRR, MIRR and PI of each project and comment.

f What are the MIRR's advantages over regular IRR?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock