Question: Group B O.24B. (Learning Objective 1: Issue bonds payable (discount); pay and accrue interest; amortize bond discount using the straight-line method) On January 31, 2018,

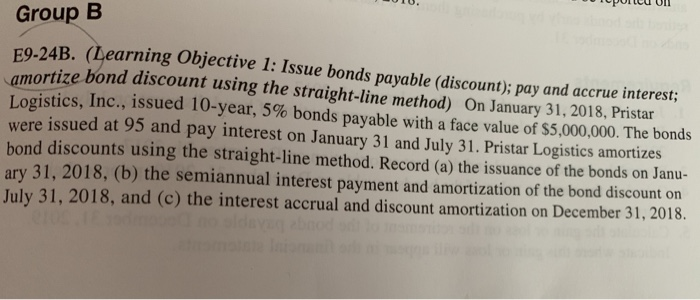

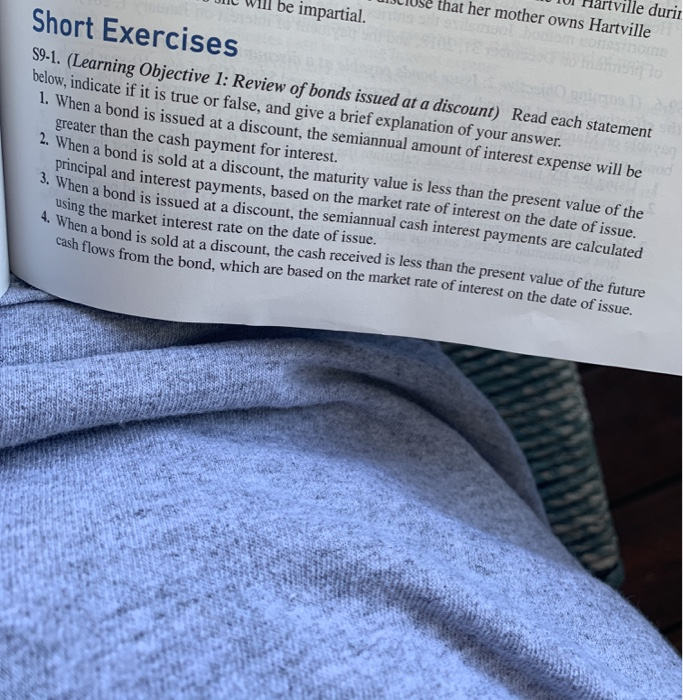

Group B O.24B. (Learning Objective 1: Issue bonds payable (discount); pay and accrue interest; amortize bond discount using the straight-line method) On January 31, 2018, Pristar Logistics, Inc., issued 10-year, 5% bonds payable with a face value of $5,000,000. The bonds were issued at 95 and pay interest on January 31 and July 31. Pristar Logistics amortizes bond discounts using the straight-line method. Record (a) the issuance of the bonds on Janu- ary 31, 2018, (b) the semiannual interest payment and amortization of the bond discount on July 31, 2018, and (c) the interest accrual and discount amortization on December 31, 2018 lle durir that her mother owns Hartville be impartial. Short Exercises S9-1. (Learning Objective 1: Review of bonds issued at a discount) Read each statement below, indicate if it is true or 1. When a bond is issued at a discount, the semiannual amount of interest expense will be greater than the cash payment for interest. 2. When a bond is sold at a discount, the maturity value is less than the present value of the principal and interest payments, based on the market rate of interest on the date of issue. When a bond is issued at a discount, the semiannual cash interest payments are calculated Using the market interest rate on the date of issue. 4. When a bond is sold at a discount, the cash received is less than the present value of the future cash flows from the bond, which are based on the market rate of interest on the date of issue. false, and give a brief explanation of your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts