Question: Group E: Case study description: 1) An overview about the project idea Due to the current busy life nature a car service that is delivered

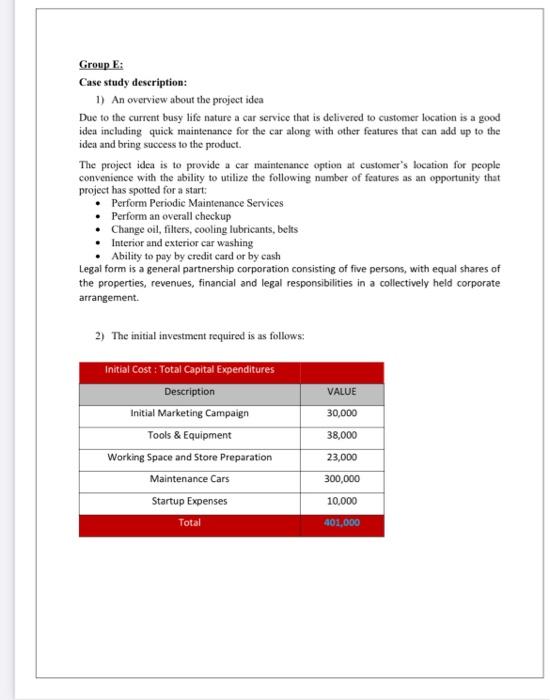

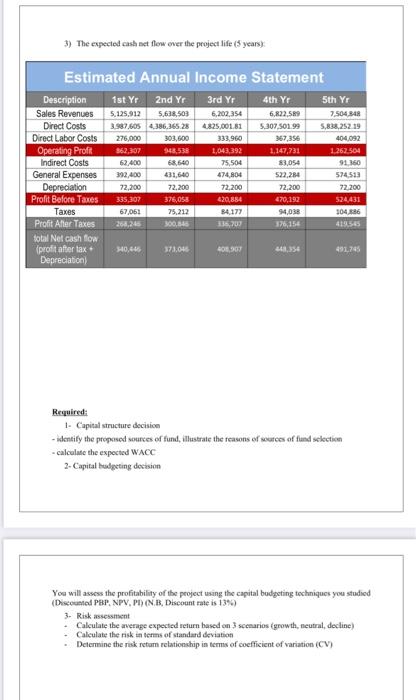

Group E: Case study description: 1) An overview about the project idea Due to the current busy life nature a car service that is delivered to customer location is a good idea including quick maintenance for the car along with other features that can add up to the idea and bring success to the product The project idea is to provide a car maintenance option at customer's location for people convenience with the ability to utilize the following number of features as an opportunity that project has spotted for a start: Perform Periodic Maintenance Services Perform an overall checkup Change oil, filters, cooling lubricants, belts Interior and exterior car washing Ability to pay by credit card or by cash Legal form is a general partnership corporation consisting of five persons with equal shares of the properties, revenues, financial and legal responsibilities in a collectively held corporate arrangement. 2) The initial investment required is as follows: VALUE 30,000 38,000 Initial Cost : Total Capital Expenditures Description Initial Marketing Campaign Tools & Equipment Working Space and Store Preparation Maintenance Cars Startup Expenses Total 23,000 300,000 10,000 401,000 3) The expected cash net flow over the project life (5 years) Estimated Annual Income Statement Description 1st YT 2nd Yr 3rd Yr 4th Yr 5th Yr Sales Revenues 5.125.912 5,638,503 6,202,354 6.822.5 7,504 348 Direct Costs 3.987,605 4386,36528 4825,001.81 5.307 501.99 5,838,252.19 Direct Labor Costs 276,000 303,600 333.960 367,354 404092 Operating Profit 362,307 948,538 1,043,392 1,147,731 1262,504 Indirect Costs 62.400 68.640 75,504 83,054 91.360 General Expenses 392,400 431,640 47404 522,284 574,513 Depreciation 72,200 72,200 72.200 72,200 72.200 Prolit Before Taxes 335,307 376,056 470,192 524431 Taxes 67,061 75.212 B4.177 94,038 304.86 Profit After Taxes 264,248 300,346 336.207 376,164 419.565 total Net cash flow (profit after tax. 40.446 373.04 OSO 2:48,354 491745 Depreciation 420,854 Required 1. Capital structure decision - identify the propesed sources of fund, illustrate the reasons of sources of fund selection calculate the expected WACC 2-Capital Bageting decision You will assess the profitability of the project using the capital budgeting techniques you studied (Discounted PBP. NPV.PD) (NB, Discount rate is 13%) 3. Risk assessment Calculate the average expected return based on 3 scenarios (growth, neutral, decline) Calculate the risk in terms of standard deviation Determine the risk return relationship in terms of coefficient of variation (CV) Group E: Case study description: 1) An overview about the project idea Due to the current busy life nature a car service that is delivered to customer location is a good idea including quick maintenance for the car along with other features that can add up to the idea and bring success to the product The project idea is to provide a car maintenance option at customer's location for people convenience with the ability to utilize the following number of features as an opportunity that project has spotted for a start: Perform Periodic Maintenance Services Perform an overall checkup Change oil, filters, cooling lubricants, belts Interior and exterior car washing Ability to pay by credit card or by cash Legal form is a general partnership corporation consisting of five persons with equal shares of the properties, revenues, financial and legal responsibilities in a collectively held corporate arrangement. 2) The initial investment required is as follows: VALUE 30,000 38,000 Initial Cost : Total Capital Expenditures Description Initial Marketing Campaign Tools & Equipment Working Space and Store Preparation Maintenance Cars Startup Expenses Total 23,000 300,000 10,000 401,000 3) The expected cash net flow over the project life (5 years) Estimated Annual Income Statement Description 1st YT 2nd Yr 3rd Yr 4th Yr 5th Yr Sales Revenues 5.125.912 5,638,503 6,202,354 6.822.5 7,504 348 Direct Costs 3.987,605 4386,36528 4825,001.81 5.307 501.99 5,838,252.19 Direct Labor Costs 276,000 303,600 333.960 367,354 404092 Operating Profit 362,307 948,538 1,043,392 1,147,731 1262,504 Indirect Costs 62.400 68.640 75,504 83,054 91.360 General Expenses 392,400 431,640 47404 522,284 574,513 Depreciation 72,200 72,200 72.200 72,200 72.200 Prolit Before Taxes 335,307 376,056 470,192 524431 Taxes 67,061 75.212 B4.177 94,038 304.86 Profit After Taxes 264,248 300,346 336.207 376,164 419.565 total Net cash flow (profit after tax. 40.446 373.04 OSO 2:48,354 491745 Depreciation 420,854 Required 1. Capital structure decision - identify the propesed sources of fund, illustrate the reasons of sources of fund selection calculate the expected WACC 2-Capital Bageting decision You will assess the profitability of the project using the capital budgeting techniques you studied (Discounted PBP. NPV.PD) (NB, Discount rate is 13%) 3. Risk assessment Calculate the average expected return based on 3 scenarios (growth, neutral, decline) Calculate the risk in terms of standard deviation Determine the risk return relationship in terms of coefficient of variation (CV)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts