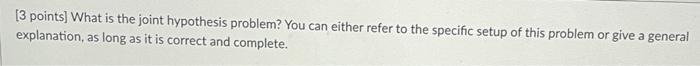

Question: Group E[t; - [] Beta Alpha #4 (highest market capitalization stocks) 6% 0.8 -0.5% #3 9% 1.0 +0.5% #2 12% 1.2 +1.5% #1 (lowest market

![Group E[t; - [] Beta Alpha #4 (highest market capitalization stocks)](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd8d0a20e28_74566fd8d09b59b2.jpg)

Group E[t; - [] Beta Alpha #4 (highest market capitalization stocks) 6% 0.8 -0.5% #3 9% 1.0 +0.5% #2 12% 1.2 +1.5% #1 (lowest market capitalization stocks) 15% 1.4 +2.5% [3 points) What is the joint hypothesis problem? You can either refer to the specific setup of this problem or give a general explanation, as long as it is correct and complete. 13 points Alphas of anomalies often decline in magnitude after the anomaly research is published. Is this finding more consistent with a rational or irrational/behavioral explanation for these anomalies? Explain your reasoning. Group E[t; - [] Beta Alpha #4 (highest market capitalization stocks) 6% 0.8 -0.5% #3 9% 1.0 +0.5% #2 12% 1.2 +1.5% #1 (lowest market capitalization stocks) 15% 1.4 +2.5% [3 points) What is the joint hypothesis problem? You can either refer to the specific setup of this problem or give a general explanation, as long as it is correct and complete. 13 points Alphas of anomalies often decline in magnitude after the anomaly research is published. Is this finding more consistent with a rational or irrational/behavioral explanation for these anomalies? Explain your reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts