Question: Grouper Computer Company sells computers for $2,400 each, which includes a three-year warranty that requires the company to perform periodic services and to replace defective

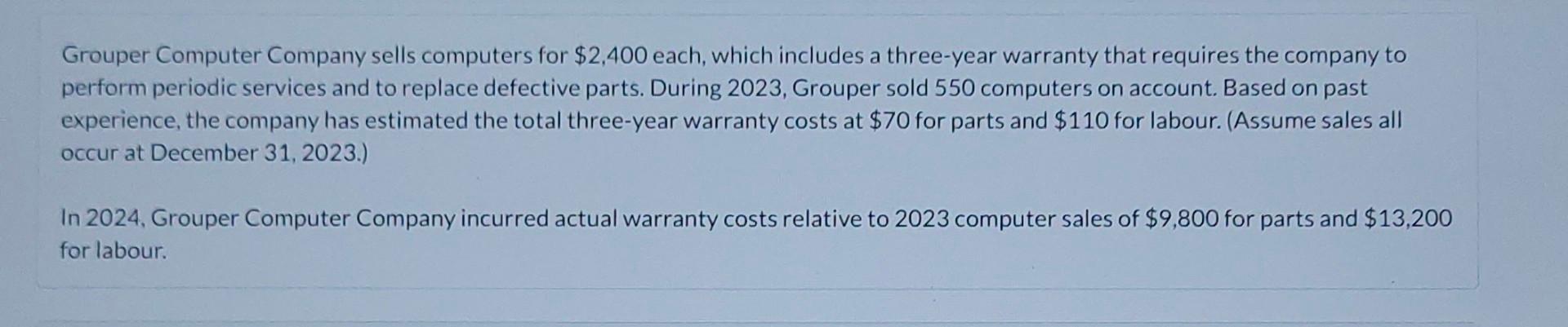

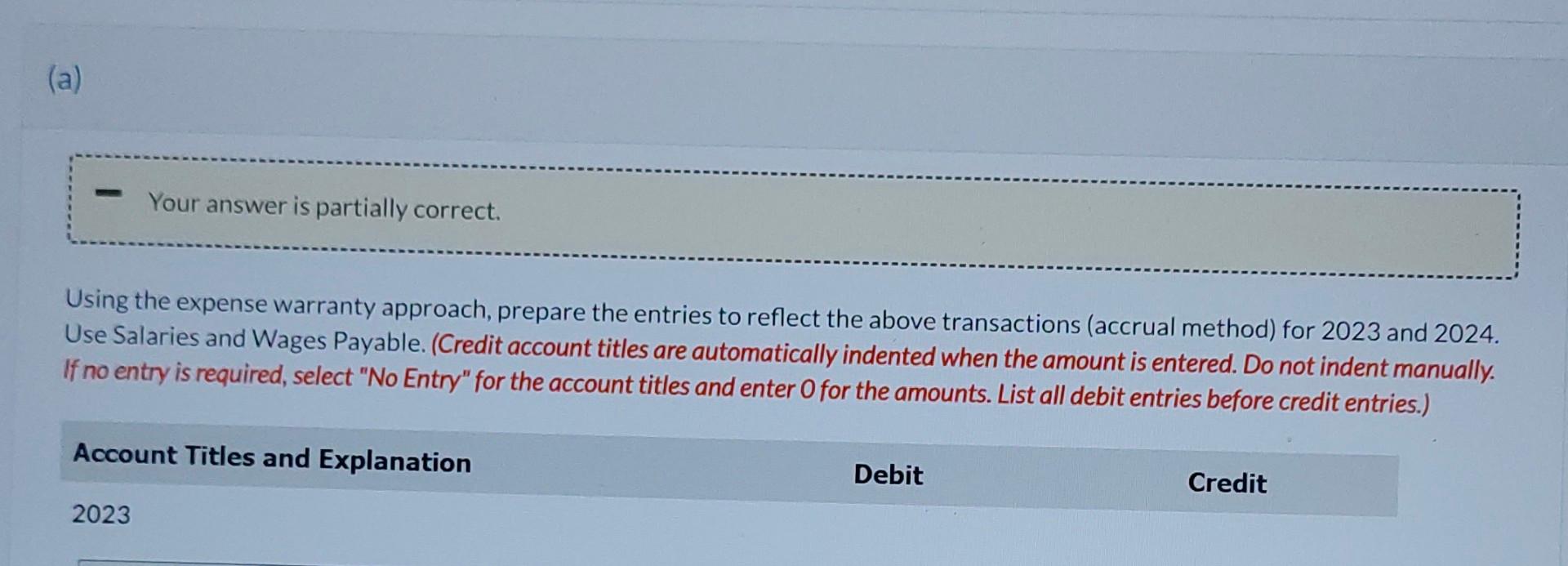

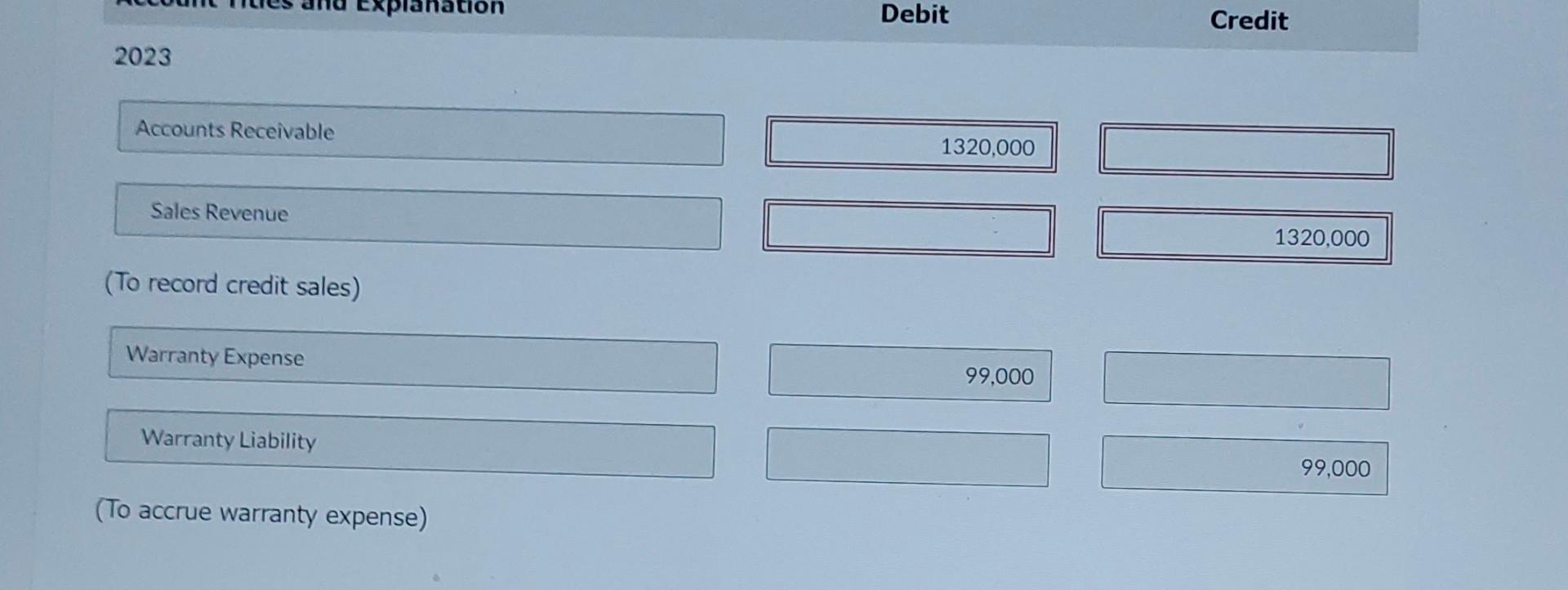

Grouper Computer Company sells computers for $2,400 each, which includes a three-year warranty that requires the company to perform periodic services and to replace defective parts. During 2023, Grouper sold 550 computers on account. Based on past experience, the company has estimated the total three-year warranty costs at $70 for parts and $110 for labour. (Assume sales all occur at December 31, 2023.) In 2024, Grouper Computer Company incurred actual warranty costs relative to 2023 computer sales of $9,800 for parts and $13,200 for labour. (a) Using the expense warranty approach, prepare the entries to reflect the above transactions (accrual method) for 2023 and 2024. Use Salaries and Wages Payable. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Debit Credit 2023 Accounts Receivable Sales Revenue (To record credit sales) Warranty Expense 99,000 Warranty Liability (To accrue warranty expense) Account Titles and Explanation Debit Credit 2024 Warranty Liability Cash \begin{tabular}{|l} \hline 23000 \\ \hline \end{tabular} (To record warranty costs)

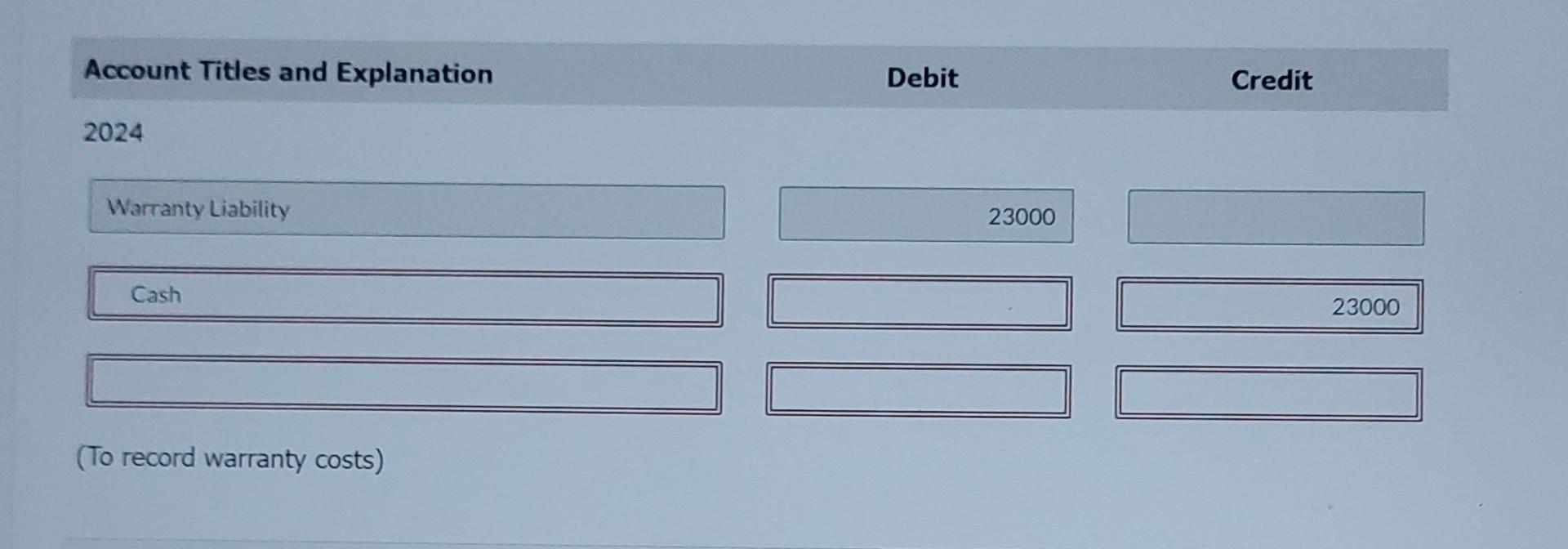

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts