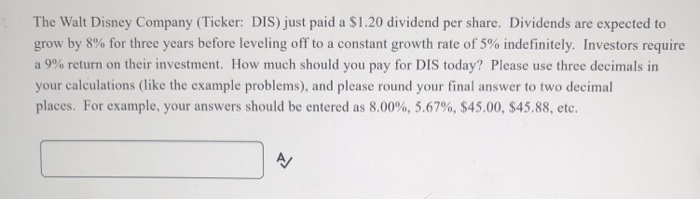

Question: grow by 8% for three years before leveling off to a constant growth rate of 5% indefinitely. Investors require a 9% return on their investment.

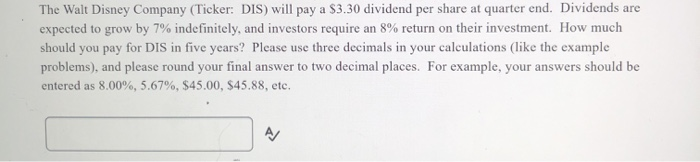

grow by 8% for three years before leveling off to a constant growth rate of 5% indefinitely. Investors require a 9% return on their investment. How much should you pay for DIS today? Please use three decimals in places. For example, your answers should be entered as 8.00%, 5.67%, $45.00, $45.88, etc The Walt Disney Company (Ticker: DIS) will pay a $3.30 dividend per share at quarter end. Dividends are expected to grow by 7% indefinitely, and investors require an 8% return on their investment. How much should you pay for DIS in five years? Please use three decimals in your calculations (like the example problems), and please round your final answer to two decimal places. For example, your answers should be entered as 8.00%, 5.67%, $45.00, $45.88, etc. D is always included in the stock price calculation, True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts