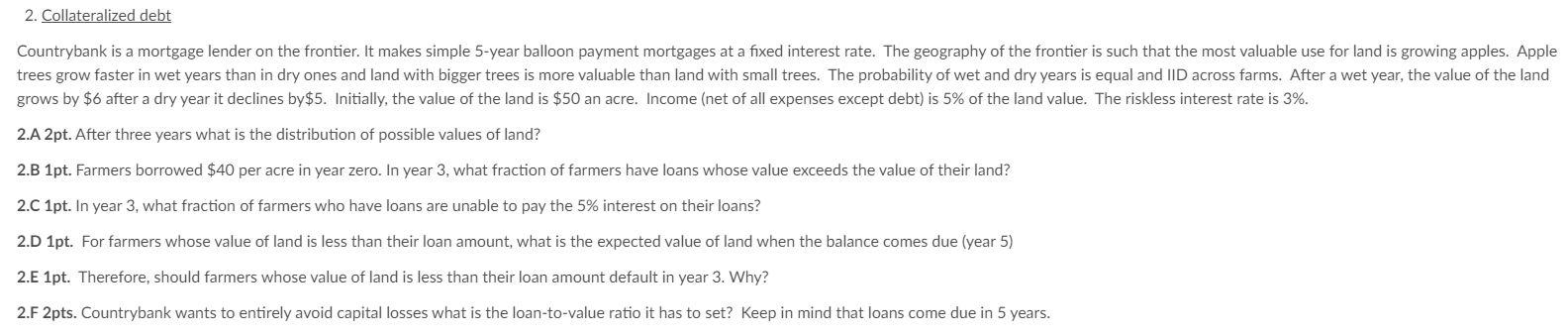

Question: grows by $6 after a dry year it declines by $5. Initially, the value of the land is $50 an acre. Income (net of all

grows by $6 after a dry year it declines by $5. Initially, the value of the land is $50 an acre. Income (net of all expenses except debt) is 5% of the land value. The riskless interest rate is 3%. 2.A 2 pt. After three years what is the distribution of possible values of land? 2.B 1 1pt. Farmers borrowed $40 per acre in year zero. In year 3 , what fraction of farmers have loans whose value exceeds the value of their land? 2.C 1pt. In year 3 , what fraction of farmers who have loans are unable to pay the 5% interest on their loans? 2.D 1pt. For farmers whose value of land is less than their loan amount, what is the expected value of land when the balance comes due (year 5) 2.E 1pt. Therefore, should farmers whose value of land is less than their loan amount default in year 3 . Why? 2.F 2pts. Countrybank wants to entirely avoid capital losses what is the loan-to-value ratio it has to set? Keep in mind that loans come due in 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts