Question: gs Review View Help Table Design Layout ACCT1115 Case Study Heavy Equipment and Machinery Inc. (HEMI) Analysis 1. The Accountant asks you to evaluate HEMI's

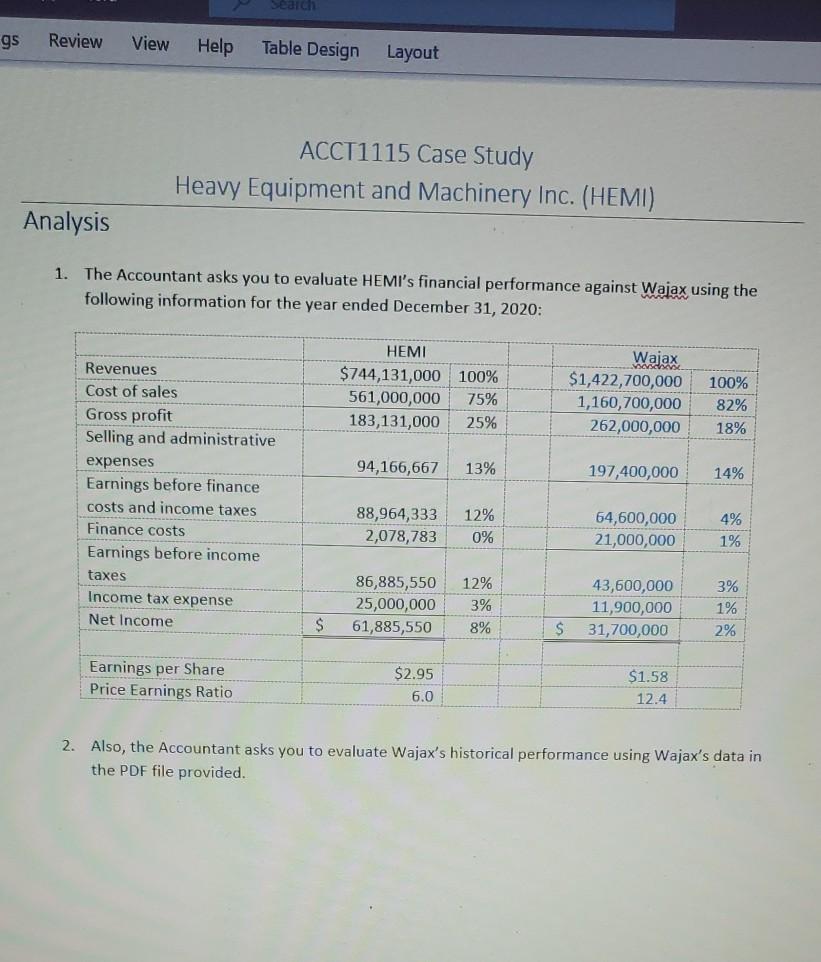

gs Review View Help Table Design Layout ACCT1115 Case Study Heavy Equipment and Machinery Inc. (HEMI) Analysis 1. The Accountant asks you to evaluate HEMI's financial performance against Wajax using the following information for the year ended December 31, 2020: Wajax HEMI $744,131,000 100% 561,000,000 75% 183,131,000 25% $1,422,700,000 1,160, 700,000 262,000,000 100% 82% 18% 94,166,667 13% 197,400,000 14% Revenues Cost of sales Gross profit Selling and administrative expenses Earnings before finance costs and income taxes Finance costs Earnings before income taxes Income tax expense Net Income 88,964,333 2,078,783 12% 0% 64,600,000 21,000,000 4% 1% 86,885,550 25,000,000 61,885,550 12% 3% 8% 43,600,000 11,900,000 31,700,000 3% 1% 2% $ $ Earnings per Share Price Earnings Ratio $2.95 6.0 $1.58 12.4 2. Also, the Accountant asks you to evaluate Wajax's historical performance using Wajax's data in the PDF file provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts