Question: Guidelines in making solutions in good form: 1. Always double rule final solutions/total (not necessarily the final answer). Single rule for subtotals. 2. Use two

Guidelines in making solutions in good form: 1. Always double rule final solutions/total (not necessarily the final answer). Single rule for subtotals. 2. Use two (2) decimal places. 3. Provide narrative explanations when necessary. 4. The answer in that problem is correct. Please provide a solution

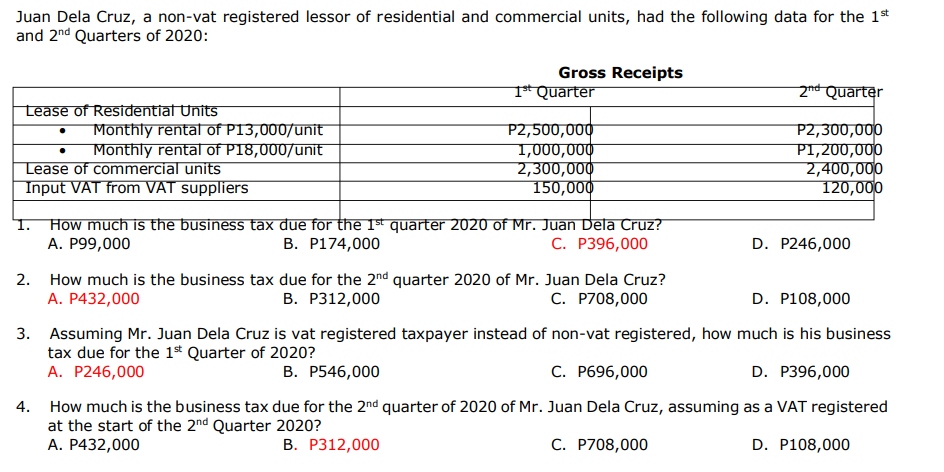

Juan Dela Cruz, a non-vat registered lessor of residential and commercial units, had the following data for the 1 st and 2nd Quarters of 2020: Gross Receipts 1* Quarter 2" Quarter Lease of Residential Units Monthly rental of P13,000/unit P2,500,000 P2,300,000 Monthly rental of P18,000/unit 1,000,000 P1, 200,000 Lease of commercial units 2,300,000 2,400,000 Input VAT from VAT suppliers 150,000 120,000 How much is the business tax due for the 1s quarter 2020 of Mr. Juan Dela Cruz? A. P99,000 B. P174,000 C. P396,000 D. P246,000 2. How much is the business tax due for the 2nd quarter 2020 of Mr. Juan Dela Cruz? A. P432,000 B. P312,000 C. P708,000 D. P108,000 3. Assuming Mr. Juan Dela Cruz is vat registered taxpayer instead of non-vat registered, how much is his business tax due for the 1s Quarter of 2020? A. P246,000 B. P546,000 C. P696,000 D. P396,000 4. How much is the business tax due for the 2nd quarter of 2020 of Mr. Juan Dela Cruz, assuming as a VAT registered at the start of the 2nd Quarter 2020? A. P432,000 B. P312,000 C. P708,000 D. P108,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts