Question: gure that is relevant for setting a minimum selling price? Due to a strike in its supplier's plant. Andrettl Company is unable to purchase more

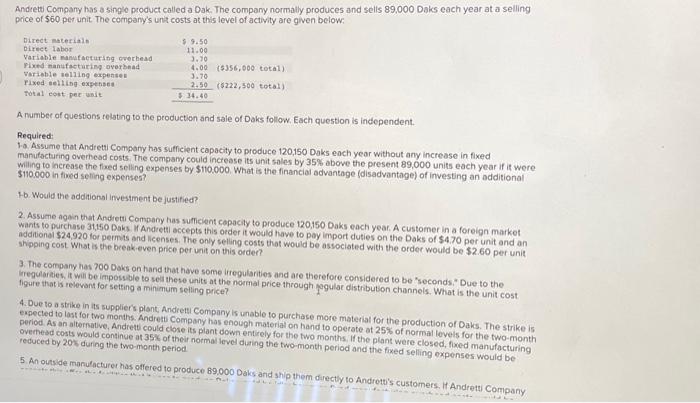

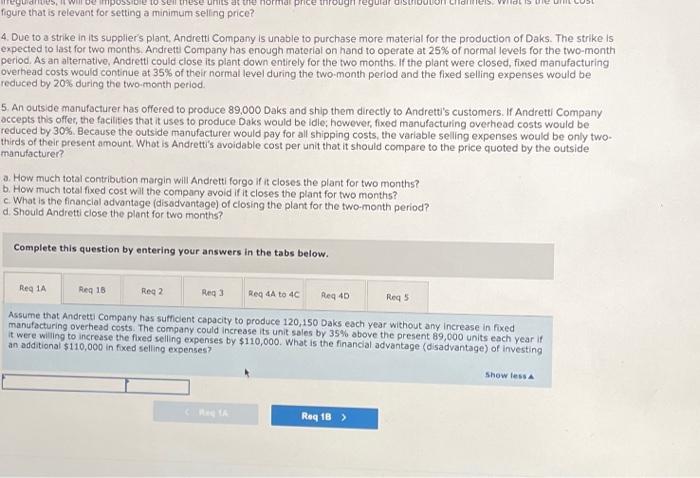

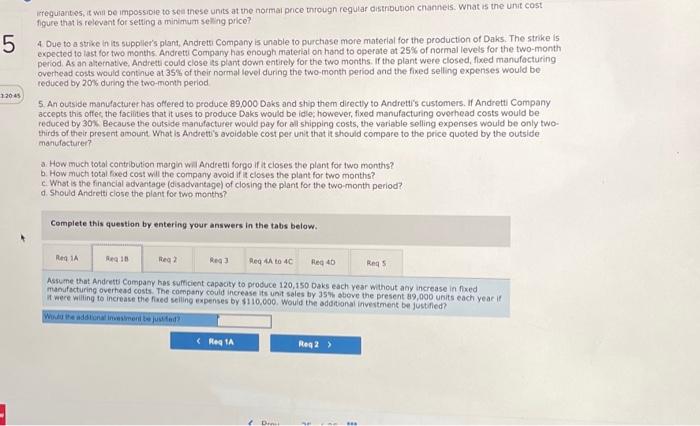

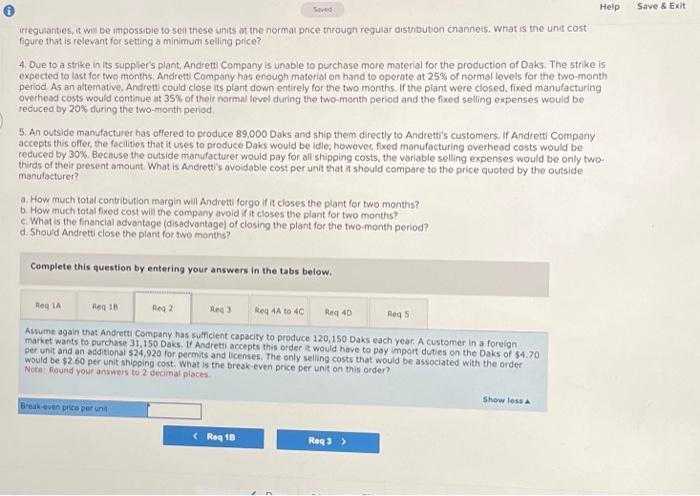

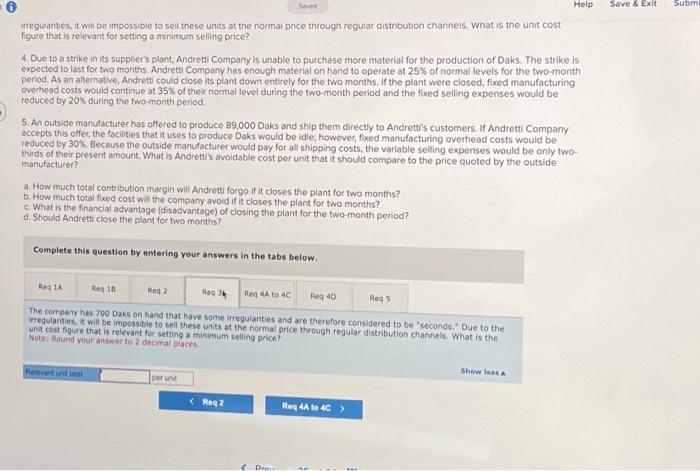

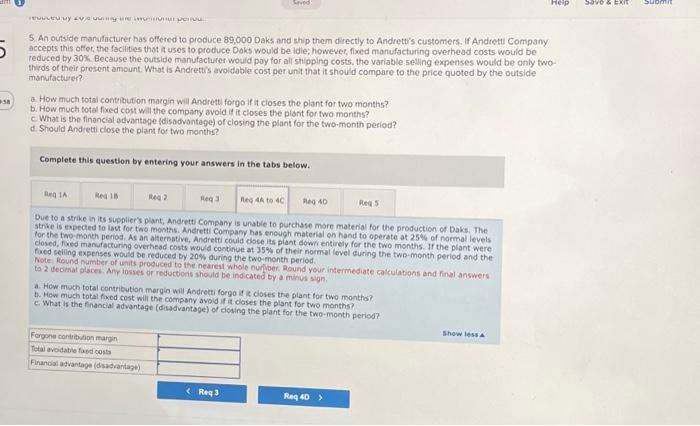

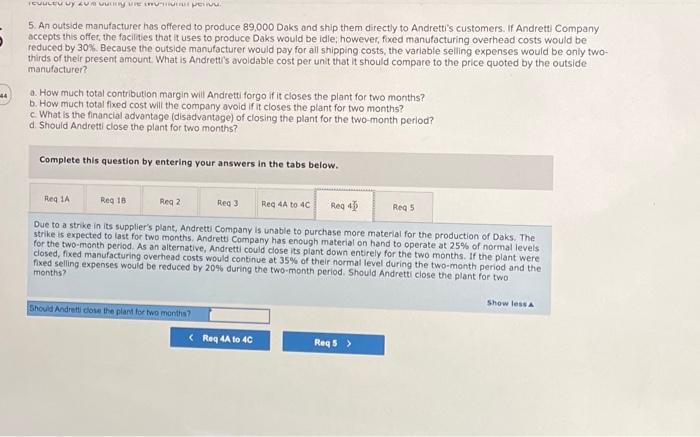

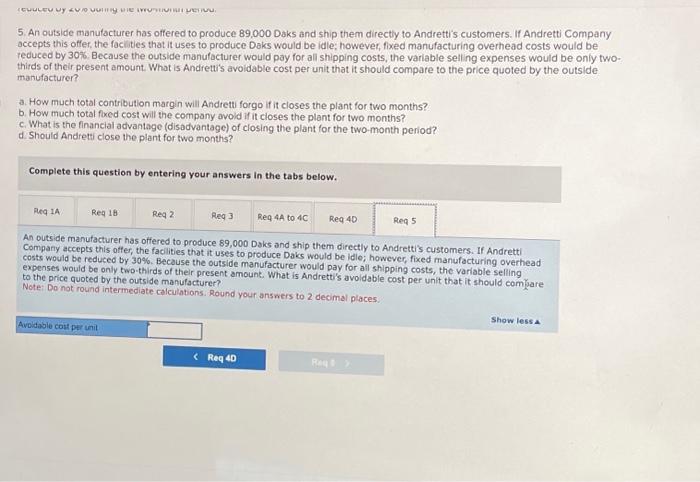

gure that is relevant for setting a minimum selling price? Due to a strike in its supplier's plant. Andrettl Company is unable to purchase more material for the production of Daks. The strike is expected to last for two months. Andretti Company has enough materiai on hand to operate at 25% of normal levels for the two-month period. As an aiternative, Andretti could close its plant down entirely for the two months. If the plant were closed, fixed manufacturing overhead costs would continue at 35% of their normal level during the two-month period and the fixed selling expenses would be educed by 20% during the two-month period. 5. An outside manufacturer has offered to produce 89,000 Daks and ship them directly to Andrett's customers. If Andretti Company ccepts this offer, the facilities that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be educed by 30%. Because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only twohirds of their present amount. Whot is Andrett's avoidable cost per unit that it should compare to the price quoted by the outside nanufacturer? a. How much total contribution margin will Andretti forgo if it closes the plant for two months? . How much total fixed cost will the company avoid if it closes the plant for two months? c. What is the financial advantage (disadvantage) of closing the plant for the two-month period? d. Should Andretti close the plant for two months? Complete this question by entering your answers in the tabs below. Assume that Andretti Company has sufficent capacity to produce 120,150 Daks each year without any increase in fixed manufacturing overtiead costs. The company could increase its unit sales by 35% above the present 89,000 units each year if it were willing to increase the fixed seling expenses by $110,000. What is the financial advantage (disadvantage) of investing an additional $110,000 in foxed selling expenses? fipure that is relevant for setting of minimum selling price? 4. Due to a strike in its supplier's plant, Andretti Company is unable to purchase more material for the production of Daks. The strike is expected to last for two months. Andreti Company has enough material on hand to operate at 25% of normal levels for the two-month period As an aliernatve. Andretti could close is plant down entirely for the two months. If the plant were closed, fixed manufocturing overtead costs would continue at 35% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20 s during the two-month period 5. An outside manufacturer has offered to produce 89,000 Daks and ship thom directly to Andrettis customers. If Andretti Company accepts this offec, the facilities that it uses to produce Daks would be idle; however, fixed manufacturing ovorhead costs would be reduced by 30% Because the outslde manufacturer woukd pay for at shippling costs, the variable selling expensos woufd be only two. thirds of their present amount What is Andrett's avoidsble cost per unit that it should compare to the price quoted by the outside manufocturer? 3. How much total contribution margin wil Andretil forgo if it closes the plant for fwo months? b. How much total foved cost will the company avold if it closes the plant for two months? c. Whst is the-financial advantage (disadvantage) of clesing the plant for the two-month period? d. Should Andretti close the plant for two months? Complete this question by entering your answers in the tabs below. Assume that Andrest Company has sufficient capocity to produce 120,150 Daks each year without aby increase in fixed mamufacturing overhead costs. The company could increase ifs unit sales by 35% ebove the present 89,000 units each year if It wece villing to increase the fined seiling expenses by $110,000, Would the odditional invertment be justalied? 5. An outside manufncturer has offered to produce 89,000 Daks and ship them directly to Andrett's customers. If Andretti Company accepts this offer, the facilities thot it uses to produce Doks would be idle; however, fixed manufacturing overhead costs would be reduced by 30 . Because the outside manufacturer would pay for alt stipping costs, the variable selling expenses would be only fwothirds of their present amount. Whot is Andrettrs avoldable cost per unit that it should compare to the price quoted by the outside manulacturer? a. How much fotal contribution margin will Andrettl forgo if it closes the plant for two months? b. How much fotal fixed cost will the company avoid if it closes the plont for two months? c. What is the financial advantoge (disadvantage) of closing the plant for the two-month period? d. Should Andretti close the plant for two months? Complete this question by entering your answers in the tabs below. Due to a strike in its suppliers plant, Andrett Company is unable to purchase more material for the production of Daks. The strive is eapected to lau for tho months. Andretti Company has enowgh material on hand to operate at 25% of nomal levels for the two month perios. As an aiternative, Andretti could dose its plant sowr entirely for the two months. If the plant were Note flound numbes would be reduced by 20% during the two-month period. a. How much total contribution margin will Andrecti forgo if it closes the plant for two months? b. How much total fixed cost will the company avoid if it closes the plant for two months? c. What is the financial advantage (disadvantage) of closing the plant for the two-month period? 5. An outside manufacturer has offered to produce 89,000 Daks and ship them directly to Andretti's customers. If Andretti Company accepts this offer, the facities that it uses to produce Daks would be idle; however, fixed manufacturing overnead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only twothirds of their present amount. What is Andrett's avoidable cost per unit that it should compare to the price quoted by the outside. manufacturen a. How much total contribution margin will Andrett forgo if it closes the plant for two months? b. How much total fored cost will the company avoid if it closes the plant for two months? c. What is the financial advantage (disadvantage) of closing the plant for the two-month period? d. Should Andretti close the plant for two months? Complete this question by entering your answers in the tabs below. An outside manufacturer has offered to produce 89,000 Daks and ship them directly to Andretti's customers. If Andretti Company accepts this offer, the faclities that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only two-thirds of their present amount. What is Andrettl's avoldable cost per unit that it should com jare to the price quoted by the outside manufacturer? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. 5. An outside manufacture has offered to produce 89,000 Daks and ship them directly to Andretti's customers. If Andretti Company accepts this offet, the facilites that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only twothirds of their present amount. What is Andrett's avoidable cost per unit that it should compare to the price quoted by the outside manufacturen a. How much total contribution margin will Andretti forgo if it closes the plant for two months? b. How much total fixed cost will the company avoid if it closes the plant for two months? c. What is the financial advantage (disadvantage) of closing the plant for the two-month period? d. Should Andretti close the plant for two months? Complete this question by entering your answers in the tabs below. Due to a strike in its supplier's plant, Andretti Company is unable to purchase more material for the production of Daks. The strike is expected to last for two months. Andretti Company has enough material on hand to operate at 25% of normal levels for the two-month period. As an alternative, Andretti could close its piant down entirely for the two months. If the plant were closed, fixed manufacturing overhead costs would continue at 35% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period, Should Andretti close the plant for two months? Andretsi Compary has a single product called a Dak. The company normally produces and sells 89.000 Daks each year at a selling price of $60 pet unit The company's unit costs at this level of activity are given below: A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: to. Assume that Andretti Company has sufficient capacity to produce 120,150 Daks each year without any increase in flixed manufacturing overhead costs. The company could increase its unit sales by 35% above the present 89,000 units each year if it were $110 to hcrease the fixed selling expenses by $110.000. What is the financial advantage (disadvantage) of investing an additional $110.000 in fixed seling expenses? 1.b. Would the additional investment be justified? 2. Assume again that Andreti Conpany has suflicient capacity to produce 120,150 Daks each year. A customer in a foreign market wants to purchase 31,150 Daks. If Andretti accepts this order it would have to pay import duties on the Daks of $4.70 per unit and an additionel $24,920 for permits and licenses. The only selling costs that would be associated with the order would be $2.60 per unit shipping cost What is the break-even price per unit on this order? 3. The company has 700 Daks on hand that have some irregularites and are therefore considered to be "seconds: " Due to the fregularties, it wai be impossble to selt these units at the normal price through yogular distribution channels. What is the unit cost figute that is relevent for setting a minimum selting price? 4. Due to a strike in its supplier's plant, Andretsi Company is unable to purchase more material for the production of Oaks. The strike is expected to last for two months. Andreti Company has enough materiat on hand to operate at 25% of normal lovels for the two-month reduced by 201 during the two-month period. 5. An outside manufacturer has offered to produce 89.000 Daks and ship them directly to Androttis customers. If Andretti Company urteguianties, it wit oe impossibie to seli these units of the normat price througn reguiar distribution channeis, What is the unit cost figure that is revevint for setting a minimum seting price? 4. Due to a strike in its supplier's plant, Andretti Company is unable to purchase more material for the production of Daks. The strike is expected to last for two months. Andretti Company hos enough material on hand to operate at 25% of normal levels for the two-month period As an alternatve, Andretti coutd close its plant down entrely for the two months, if the plant were closed, fixed manufacturing overhead costs would continue at 35% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period. 5. An outside monufacturer has ofrered to produce 89,000 Daks and ship them directly to Andrettis customers. If Andretti Company occepts this offer, the focities that it uses to produce Daks would be idle; however, foxed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the variable seling expenses would be only twothids of their present amount. What is. Andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer? a. How much total contribution margin will Andretsi forpo if it closes the plant for two months? b. How much total fixed cost will the company avoid if is closes the plant for two months? c. What is the financlal advantage (disadvantage) of ciosing the plant for the fwo-month period? d. Should Andrett close the plant for two months? Complete this question by entering your answers in the tabs below. The compacy has 700 Daks on hand that have some iregularities and are therefore considered to be 'seconds." Due to the irregularities, it will be impossible to seli these unts at the normal price through regular distribution channels, What is the unt cost figure that is relevant for setting a minimum selling price? hoteridound your answer to 2 decimal blaces

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts