Question: Gyan Inc is a UK based Multi-National Company that performs a part of its business operation in Hong Kong. The income statement for the Accounting

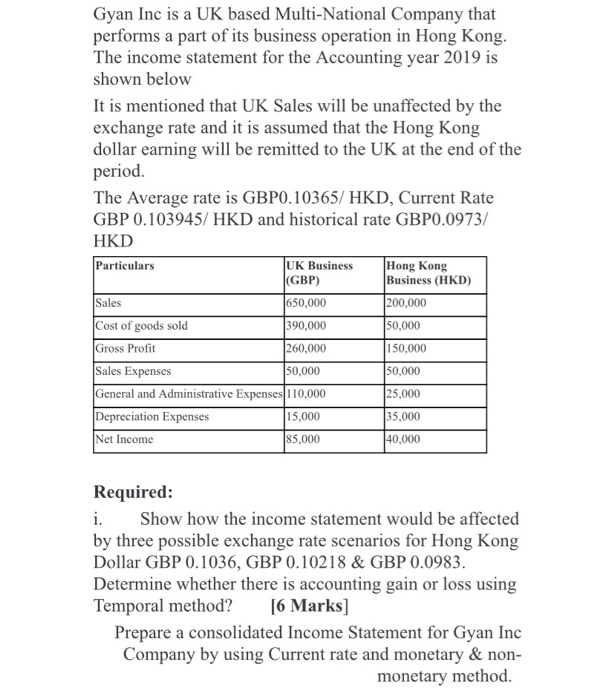

Gyan Inc is a UK based Multi-National Company that performs a part of its business operation in Hong Kong. The income statement for the Accounting year 2019 is shown below It is mentioned that UK Sales will be unaffected by the exchange rate and it is assumed that the Hong Kong dollar earning will be remitted to the UK at the end of the period. The Average rate is GBP0.10365/HKD, Current Rate GBP 0.103945/HKD and historical rate GBP0.0973/ HKD Particulars UK Business Hong Kong (GBP) Business (HKD) Sales 650,000 200,000 Cost of goods sold 390,000 50,000 Gross Profit 260,000 150,000 Sales Expenses 50,000 50,000 General and Administrative Expenses 110,000 25,000 Depreciation Expenses 15,000 35,000 Net Income 85,000 40,000 Required: i. Show how the income statement would be affected by three possible exchange rate scenarios for Hong Kong Dollar GBP 0.1036, GBP 0.10218 & GBP 0.0983. Determine whether there is accounting gain or loss using Temporal method? [6 Marks] Prepare a consolidated Income Statement for Gyan Inc Company by using Current rate and monetary & non- monetary method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts