Question: h 0 docs.google.com P Pearson Mylab and Mas... 3 weeks 14 15 - Financi... D STOCKS PROJECT Part... Financial Accounting (A... + Google Sheets C

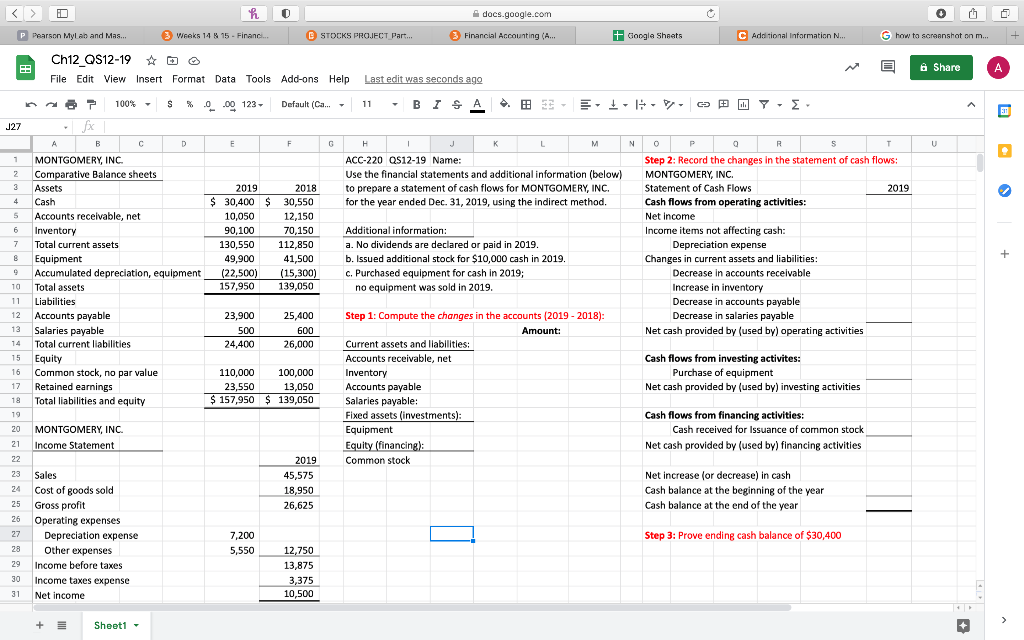

h 0 docs.google.com P Pearson Mylab and Mas... 3 weeks 14 15 - Financi... D STOCKS PROJECT Part... Financial Accounting (A... + Google Sheets C Additional Information N... G how to screenshot on m... -- Ch12 QS12-19 OG File Edit View Insert Format Data Tools Add-ons Help E Share Last edit was seconds ago 100% - S %0.00 123 Default (Ca... 11 - BISA - Y - Z 311 J27 fx A A B C D E F G N R U H H K L M ACC-220 QS12-19 Name: Use the financial statements and additional information (below) to prepare a statement of cash flows for MONTGOMERY, INC. for the year ended Dec 31, 2019, using the indirect method. 2019 2018 $ 30,400 $ 30,550 10,050 12,150 90,100 70,150 130,550 112,850 49,900 41,500 (22,500) (15,300) 157,950 139,050 0 P S T Step 2: Record the changes in the statement of cash flows: MONTGOMERY, INC. Statement of Cash Flows 2019 Cash flows from operating activities: Net Income Income items not affecting cash: Depreciation expense Changes in current assets and liabilities: Decrease in accounts receivable Increase in inventory Decrease in accounts payable Decrease in salaries payable Net cash provided by (used by) operating activities Additional information: a. No dividends are declared or paid in 2019 b. Issued additional stock for $10,000 cash in 2019. C. Purchased equipment for cash in 2019; no equipment was sold in 2019. + 23,900 500 24,400 25,400 600 26,000 1 MONTGOMERY, INC. 2 Comparative Balance sheets 3 3 Assets 4 Cash 5 Accounts receivable, net 6 Inventory Total current assets 8 Equipment 9 Accumulated depreciation, equipment 10 Total assets 11 Liabilities 12 Accounts payable 13 Salaries payable 14 Total current liabilities 15 Equity 16 Common stock, no par value 17 Retained earnings 18 Total liabilities and equity 19 20 MONTGOMERY, INC. 21 Income Statement 22 23 Sales 24 Cost of goods sold 25 Gross profit 26 Operating expenses 27 Depreciation expense 28 Other expenses 29 Income before taxes 30 Income taxes expense 31 Net Income 110,000 100,000 23,550 13,050 $ 157,950 $ 139,050 Step 1: Compute the changes in the accounts (2019 - 2018) Amount: Current assets and liabilities: Accounts receivable, net Inventory Accounts payable Salaries payable: Fixed assets (investments): Equipment Equity (financing): Common stock Cash flows from investing activites: Purchase of equipment Net cash provided by (used by) investing activities ) Cash flows from financing activities: Cash received for Issuance of common stock Net cash provided by (used by) financing activities T 2019 45,575 18,950 26,625 Net increase for decrease) in cash Cash balance at the beginning of the year Cash balance at the end of the year Step 3: Prove ending cash balance of $30,400 7,200 5,550 12,750 13,875 3,375 10,500 + Sheet1 - h 0 docs.google.com P Pearson Mylab and Mas... 3 weeks 14 15 - Financi... D STOCKS PROJECT Part... Financial Accounting (A... + Google Sheets C Additional Information N... G how to screenshot on m... -- Ch12 QS12-19 OG File Edit View Insert Format Data Tools Add-ons Help E Share Last edit was seconds ago 100% - S %0.00 123 Default (Ca... 11 - BISA - Y - Z 311 J27 fx A A B C D E F G N R U H H K L M ACC-220 QS12-19 Name: Use the financial statements and additional information (below) to prepare a statement of cash flows for MONTGOMERY, INC. for the year ended Dec 31, 2019, using the indirect method. 2019 2018 $ 30,400 $ 30,550 10,050 12,150 90,100 70,150 130,550 112,850 49,900 41,500 (22,500) (15,300) 157,950 139,050 0 P S T Step 2: Record the changes in the statement of cash flows: MONTGOMERY, INC. Statement of Cash Flows 2019 Cash flows from operating activities: Net Income Income items not affecting cash: Depreciation expense Changes in current assets and liabilities: Decrease in accounts receivable Increase in inventory Decrease in accounts payable Decrease in salaries payable Net cash provided by (used by) operating activities Additional information: a. No dividends are declared or paid in 2019 b. Issued additional stock for $10,000 cash in 2019. C. Purchased equipment for cash in 2019; no equipment was sold in 2019. + 23,900 500 24,400 25,400 600 26,000 1 MONTGOMERY, INC. 2 Comparative Balance sheets 3 3 Assets 4 Cash 5 Accounts receivable, net 6 Inventory Total current assets 8 Equipment 9 Accumulated depreciation, equipment 10 Total assets 11 Liabilities 12 Accounts payable 13 Salaries payable 14 Total current liabilities 15 Equity 16 Common stock, no par value 17 Retained earnings 18 Total liabilities and equity 19 20 MONTGOMERY, INC. 21 Income Statement 22 23 Sales 24 Cost of goods sold 25 Gross profit 26 Operating expenses 27 Depreciation expense 28 Other expenses 29 Income before taxes 30 Income taxes expense 31 Net Income 110,000 100,000 23,550 13,050 $ 157,950 $ 139,050 Step 1: Compute the changes in the accounts (2019 - 2018) Amount: Current assets and liabilities: Accounts receivable, net Inventory Accounts payable Salaries payable: Fixed assets (investments): Equipment Equity (financing): Common stock Cash flows from investing activites: Purchase of equipment Net cash provided by (used by) investing activities ) Cash flows from financing activities: Cash received for Issuance of common stock Net cash provided by (used by) financing activities T 2019 45,575 18,950 26,625 Net increase for decrease) in cash Cash balance at the beginning of the year Cash balance at the end of the year Step 3: Prove ending cash balance of $30,400 7,200 5,550 12,750 13,875 3,375 10,500 + Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts