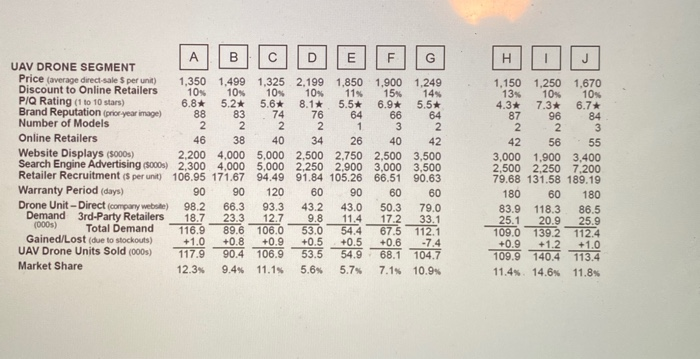

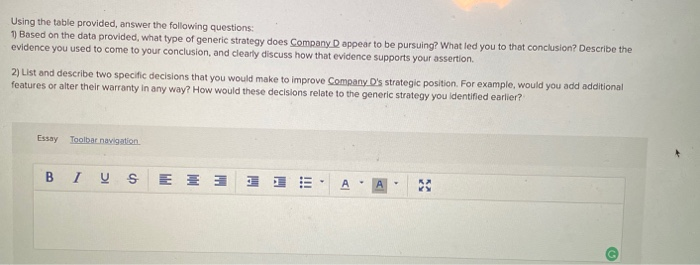

Question: H 10% 84 34 B D E F G UAV DRONE SEGMENT Price (average direct sale $ per unit) 1,350 1,499 1,325 2,199 1.850 1.900

H 10% 84 34 B D E F G UAV DRONE SEGMENT Price (average direct sale $ per unit) 1,350 1,499 1,325 2,199 1.850 1.900 1.249 Discount to Online Retailers 10% 10% 10% 11% 15% 14% PIQ Rating (1 to 10 stars) 6.8* 5.2* 5.6* 8.16 5.5* 6.9* 5.5* Brand Reputation (prior year image) 88 83 74 76 64 66 64 Number of Models 2 2 2 2 1 3 2 Online Retailers 46 38 40 26 40 42 Website Displays (5000) 2,200 4.000 5,000 2.500 2.750 2,500 3,500 Search Engine Advertising (5000s) 2,300 4.000 5,000 2.250 2,900 3,000 3,500 Retailer Recruitment ($ per unit) 106.95 171.67 94.49 91.84 105.26 66.51 90.63 Warranty Period (days) 90 90 120 60 60 60 Drone Unit - Direct (company website) 98.2 66.3 93.3 43.2 43.0 50.3 79.0 Demand 3rd-Party Retailers 18.7 23.3 12.7 9.8 11.4 17.2 33.1 (000) Total Demand 116.9 89.6 106.0 53.0 54.4 67 Gained/Lost (due to stockouts) +1.0 +0.8 +0.9 +0.5 +0.5 +0.6 -7.4 UAV Drone Units Sold (000s) 117.9 90.4 106.9 53.5 54.9 68.1 104.7 Market Share 12.3 11.15 5.6% 5.7% 7.1% 10.9 1,150 1,250 1,670 13 10% 10 4.3* 7.3* 6.7* 87 96 2 2 3 42 56 55 3,000 1,900 3,400 2.500 2.250 7.200 79.68 131.58 189.19 180 60 180 83.9 118.3 86.5 25.1 20.9 25.9 109.0 139.2 112.4 +0.9 +1.2 +1.0 109.9 140.4 113.4 11.45 14.6% 11.8% 90 Using the table provided, answer the following questions: 1) Based on the data provided, what type of generic strategy does Company D appear to be pursuing? What led you to that conclusion? Describe the evidence you used to come to your conclusion, and clearly discuss how that evidence supports your assertion 2) List and describe two specific decisions that you would make to improve Company D's strategic position. For example, would you add additional features or alter their warranty in any way? How would these decisions relate to the generic strategy you identified earlier? Essay Toolbar navigation BI VS E 5 c H 10% 84 34 B D E F G UAV DRONE SEGMENT Price (average direct sale $ per unit) 1,350 1,499 1,325 2,199 1.850 1.900 1.249 Discount to Online Retailers 10% 10% 10% 11% 15% 14% PIQ Rating (1 to 10 stars) 6.8* 5.2* 5.6* 8.16 5.5* 6.9* 5.5* Brand Reputation (prior year image) 88 83 74 76 64 66 64 Number of Models 2 2 2 2 1 3 2 Online Retailers 46 38 40 26 40 42 Website Displays (5000) 2,200 4.000 5,000 2.500 2.750 2,500 3,500 Search Engine Advertising (5000s) 2,300 4.000 5,000 2.250 2,900 3,000 3,500 Retailer Recruitment ($ per unit) 106.95 171.67 94.49 91.84 105.26 66.51 90.63 Warranty Period (days) 90 90 120 60 60 60 Drone Unit - Direct (company website) 98.2 66.3 93.3 43.2 43.0 50.3 79.0 Demand 3rd-Party Retailers 18.7 23.3 12.7 9.8 11.4 17.2 33.1 (000) Total Demand 116.9 89.6 106.0 53.0 54.4 67 Gained/Lost (due to stockouts) +1.0 +0.8 +0.9 +0.5 +0.5 +0.6 -7.4 UAV Drone Units Sold (000s) 117.9 90.4 106.9 53.5 54.9 68.1 104.7 Market Share 12.3 11.15 5.6% 5.7% 7.1% 10.9 1,150 1,250 1,670 13 10% 10 4.3* 7.3* 6.7* 87 96 2 2 3 42 56 55 3,000 1,900 3,400 2.500 2.250 7.200 79.68 131.58 189.19 180 60 180 83.9 118.3 86.5 25.1 20.9 25.9 109.0 139.2 112.4 +0.9 +1.2 +1.0 109.9 140.4 113.4 11.45 14.6% 11.8% 90 Using the table provided, answer the following questions: 1) Based on the data provided, what type of generic strategy does Company D appear to be pursuing? What led you to that conclusion? Describe the evidence you used to come to your conclusion, and clearly discuss how that evidence supports your assertion 2) List and describe two specific decisions that you would make to improve Company D's strategic position. For example, would you add additional features or alter their warranty in any way? How would these decisions relate to the generic strategy you identified earlier? Essay Toolbar navigation BI VS E 5 c