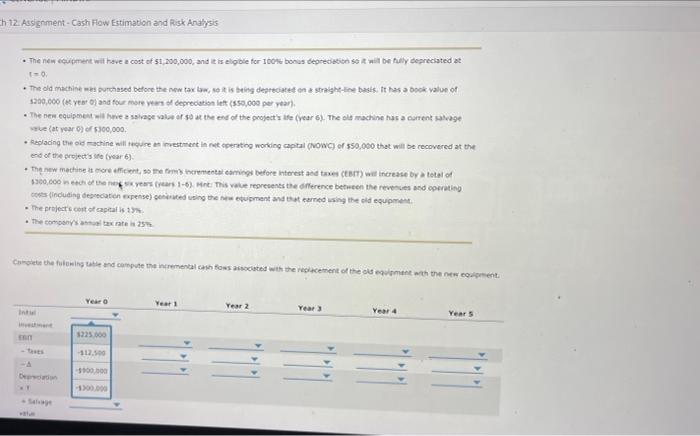

Question: h 12. Assignment-Cash How Estimation and Risk Analysis The new couement wit have a cost of $1,200,000, and selgible for 1001 bonus depreciations will be

h 12. Assignment-Cash How Estimation and Risk Analysis The new couement wit have a cost of $1,200,000, and selgible for 1001 bonus depreciations will be fully depreciated The old machine was purchased before the new tax bww, so is being depreciated on a straighte basis. It has a dock value of 5200.000 (yes) and out more years of depreciation of ($50,000 per year) The new equipment we savage value of out the end of the project's te (year 6). The machine has a current salvage e at year of 5.300,000 * Reading the old machine will be an investment in het operating working capital (NowC) of $50,000 that will be recovered at the et of the project's year 6) the new machine is more efficient, so the incrementat eaming before interest and taxes (ET) will increase by total of 1.500,000 nach of the new years (years 1-6). Het: This vale represents the difference between the revenues and operating corts Induting deprecaten expensesented using the wpment and earned using the old equipment The projecte cost of capitalis . The company tax rates 25 Comote the following take and camote me cremental con tous cated with the recitacement of the old woment with the new equipment. Year o Year 1 Year 2 Years Intl Year 4 Years - -312.500 -1100.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts