Question: h . 5 - 6 & 8 ) i Saved Help ( Required information Question 5 [ The following information applies to the questions displayed

h & i

Saved

Help

Required information

Question

The following information applies to the questions displayed below.

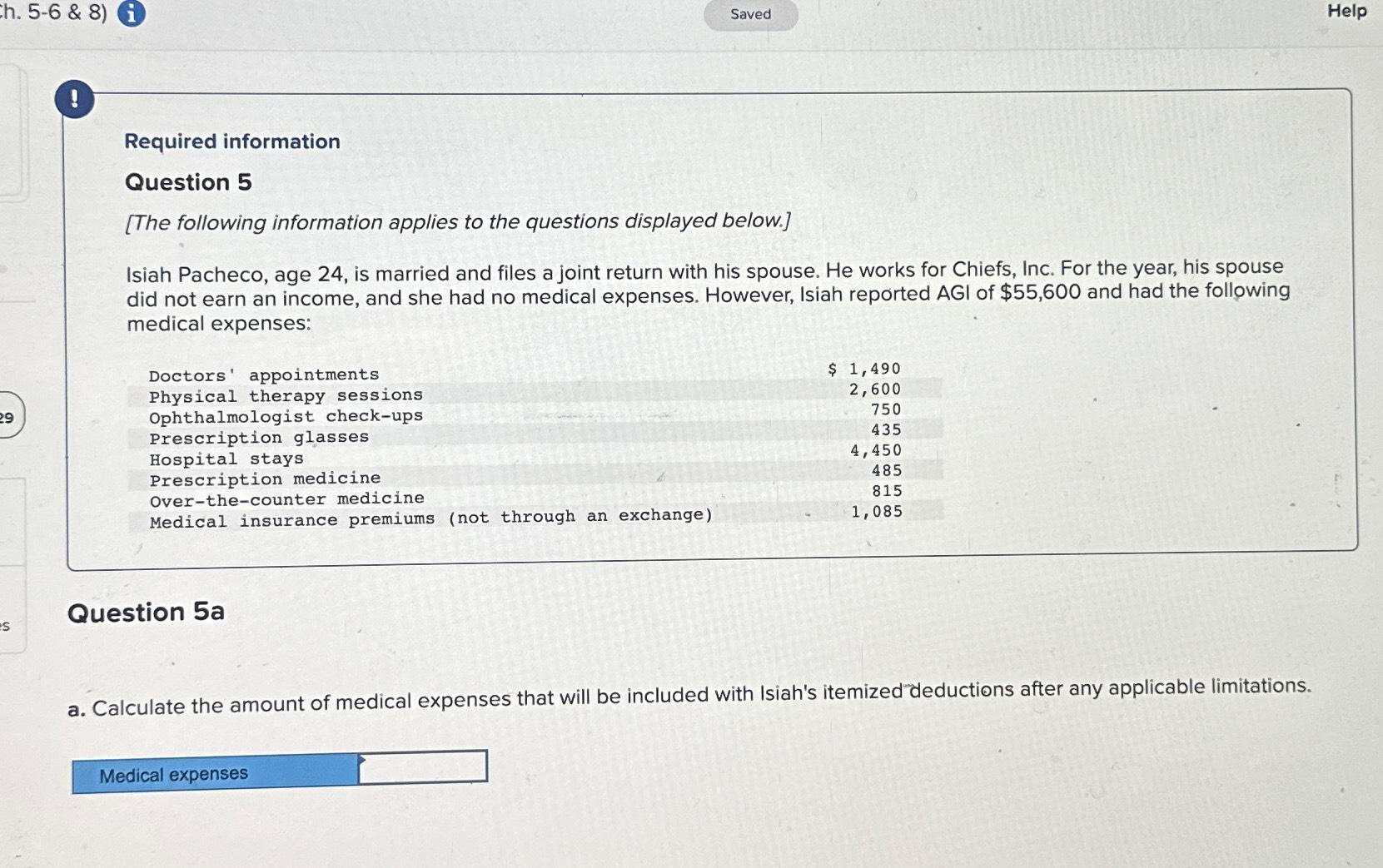

Isiah Pacheco, age is married and files a joint return with his spouse. He works for Chiefs, Inc. For the year, his spouse did not earn an income, and she had no medical expenses. However, Isiah reported AGI of $ and had the following medical expenses:

Doctors' appointments

Physical therapy sessions

Ophthalmologist checkups

Prescription glasses

Hospital stays

Prescription medicine

overthecounter medicine

Medical insurance premiums not through an exchange

$

Question a

a Calculate the amount of medical expenses that will be included with Isiah's itemized deductions after any applicable limitations

Medical expenses

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock