Question: h. 7-9) Saved Help Save & Exit Submit Rodriguez Company pays $320,000 for real estate plus $16,960 in closing costs. The real estate consists of

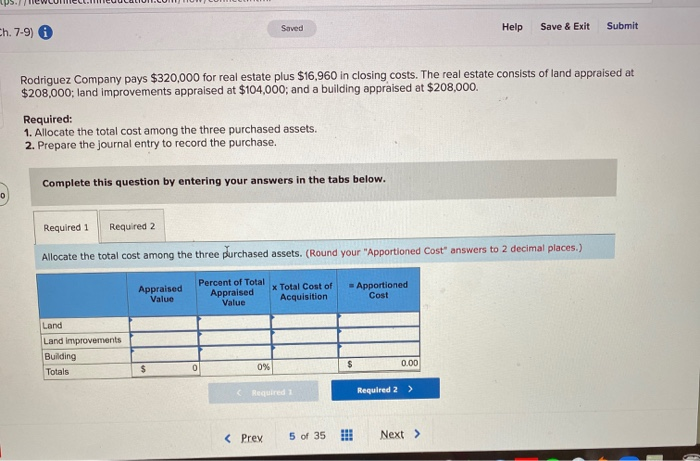

h. 7-9) Saved Help Save & Exit Submit Rodriguez Company pays $320,000 for real estate plus $16,960 in closing costs. The real estate consists of land appraised at $208,000; land improvements appraised at $104,000; and a building appraised at $208,000. Required: 1. Allocate the total cost among the three purchased assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three purchased assets. (Round your "Apportioned Cost" answers to 2 decimal places.) Appraised Value Percent of Total Appraised Value x Total Cost of Acquisition = Apportioned Cost Land Land improvements Building Totals $ 0 0% 0.00 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts