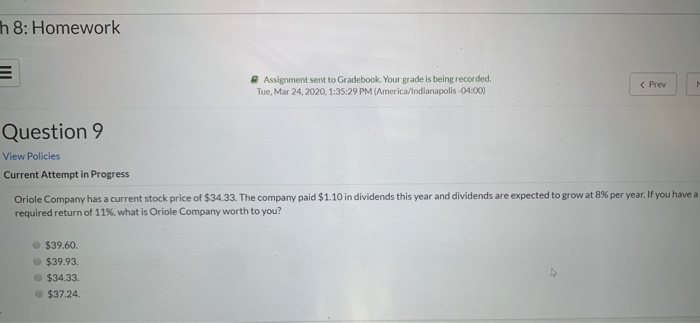

Question: h 8: Homework Assignment sent to Gradebook. Your grade is being recorded. Tue, Mar 24, 2020, 1:35:29 PM (America/Indianapolis -04:00) Question 11 View Policies Show

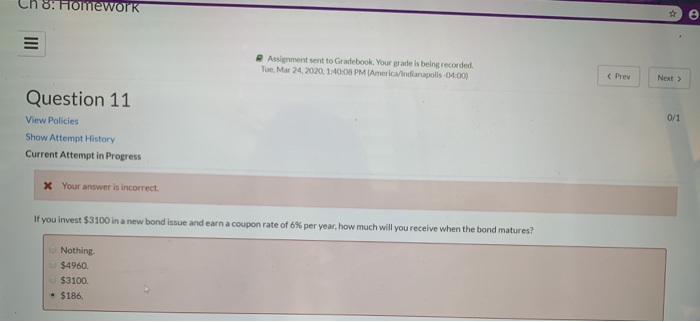

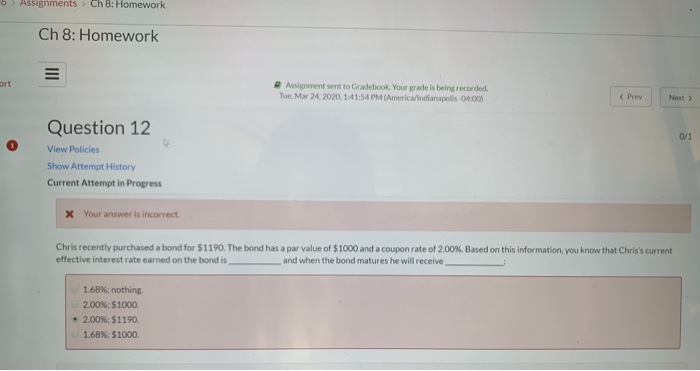

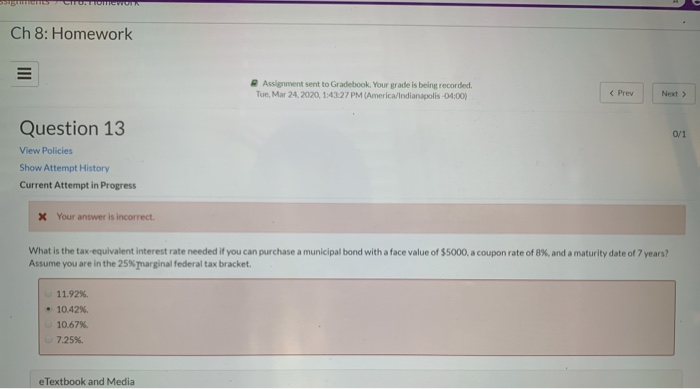

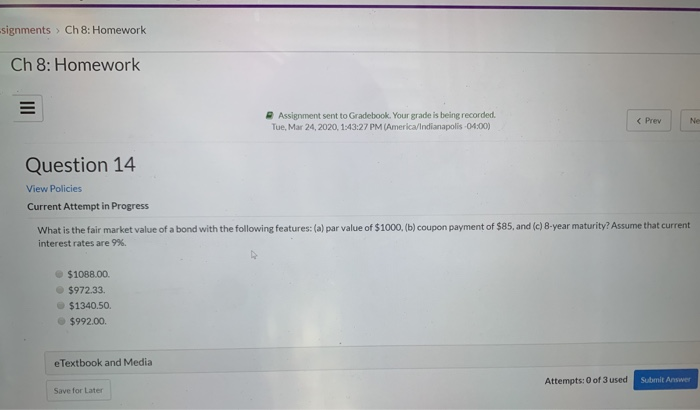

h 8: Homework Assignment sent to Gradebook. Your grade is being recorded. Tue, Mar 24, 2020, 1:35:29 PM (America/Indianapolis -04:00) Question 11 View Policies Show Attempt History Current Attempt in Progress X Your answer is incorrect. If you invest $3100 in a new bond issue and earn a coupon rate of 6% per year, how much will you receive when the bond matures? Nothing $4960 $3100. $186. Assignments > Ch 8: Homework Ch 8: Homework Assement sent to Gradebook Your gadis being recorded Tue Mar 242020 1:41:54 PM America/Indianapos-04.00) Question 12 0/1 View Policies Show Attempt History Current Attempt in Progress X Your answer is incorrect. Chris recently purchased a bond for $1190. The bond has a par value of $1000 and a coupon rate of 2.00%. Based on this information, you know that Chris's current effective interest rate earned on the bond is and when the bond matures he will receive 1.68%: nothing 200%: $1000 2.00%: 51190 1.68%: 51000 CIFUSIOMIS Ch 8: Homework Assignment sent to Gradebook. Your grade is being recorded Tue Mar 24, 2020, 1:43:27 PM (America/Indianapolis-04:00) Question 13 0/1 View Policies Show Attempt History Current Attempt in Progress x Your answer is incorrect. What is the tax-equivalent interest rate needed if you can purchase a municipal bond with a face value of $5000, a coupon rate of 8%, and a maturity date of 7 years? Assume you are in the 25% marginal federal tax bracket 11.92% 10.42% 10.67% 7.25% e Textbook and Media -signments > Ch 8: Homework Ch 8: Homework Assignment sent to Gradebook. Your grade is being recorded. Tue, Mar 24, 2020, 1:43:27 PM (America/Indianapolis -04:00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts