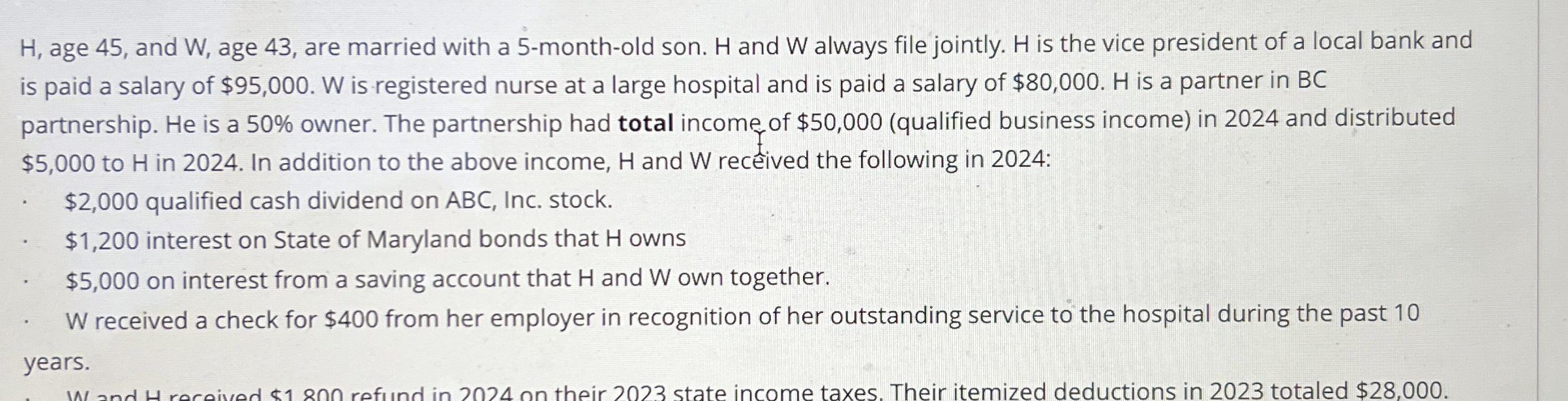

Question: H , age 4 5 , and W , age 4 3 , are married with a 5 - month - old son. H and

age and age are married with a monthold son. and always file jointly. is the vice president of a local bank and

is paid a salary of $ W is registered nurse at a large hospital and is paid a salary of $ H is a partner in

partnership. He is a owner. The partnership had total income of $qualified business income in and distributed

$ to H in In addition to the above income, H and W received the following in :

$ qualified cash dividend on ABC, Inc. stock.

$ interest on State of Maryland bonds that H owns

$ on interest from a saving account that and W own together.

W received a check for $ from her employer in recognition of her outstanding service to the hospital during the past

years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock