Question: h c h o o e 10.20 cost and Unit Copy Centre d e res. The company started the yew 100 conto weg -average cost

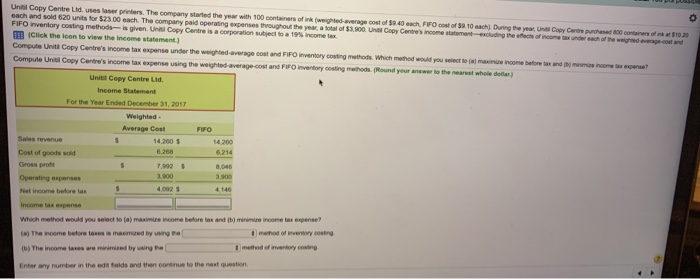

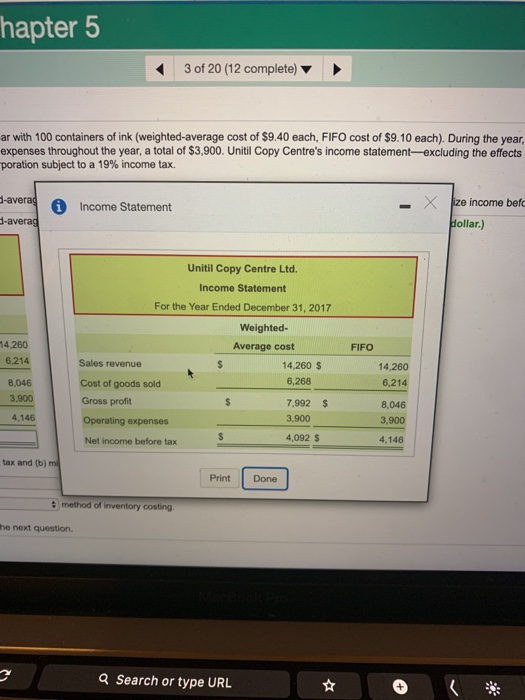

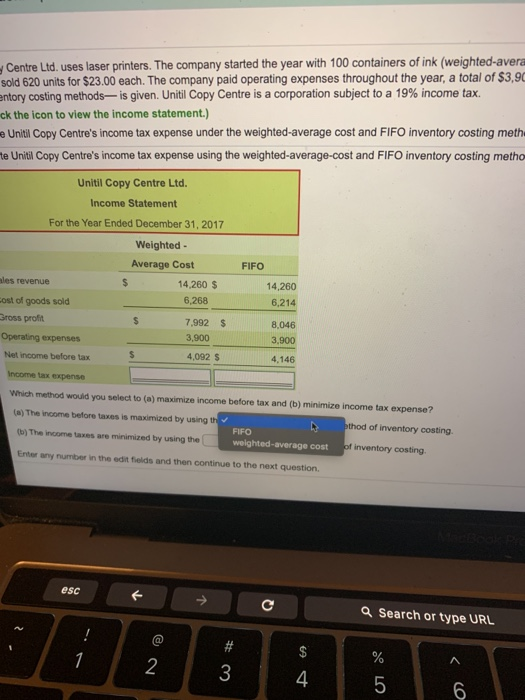

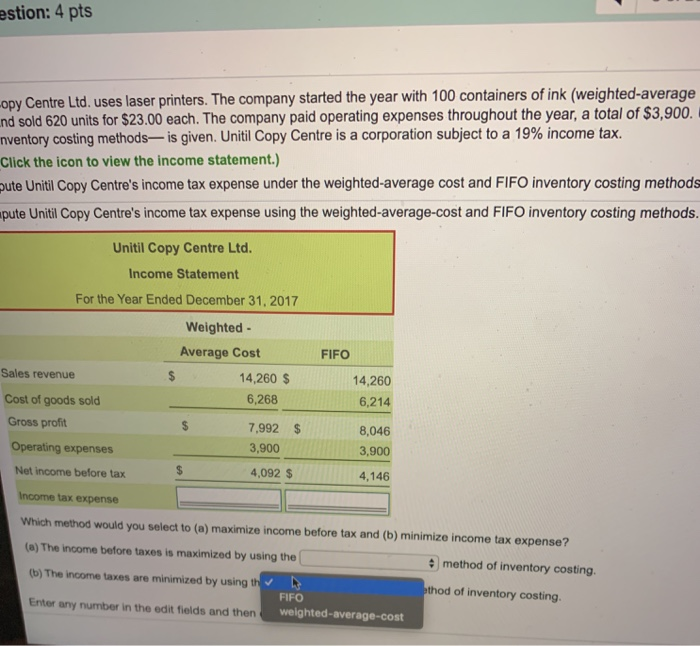

h c h o o e 10.20 cost and Unit Copy Centre d e res. The company started the yew 100 conto weg -average cost of $9.40 each, Focost of 89.10 each During the year Una Copy C each and sold 620 units for $23.00 each. The company paid operating expenses throughout the year, a total of $3.900 Unit Copy Centre income statement excluding the economi FIFO inventory costing methods is given Unit Copy Centre is a corporation subject to a 19% income tax HEB Cick the icon to view the income statement) Compute Unit Copy Centre's income tax expense under the weighted average cost and FIFO inventory costing methods. Which method would you com e income before and m Compute Un Copy Cantre's income tax expense using the weighted average cost and Fo tory cong s ound ) o re ! Uniti Copy Centre Lid. Income Statement For the Year Ended December 31, 2017 Weighted Average Cost FIFO Sales revenue Couto good Newme before tax m Which method would you select tea income before tax and th e income tax expense? method of mentory The income tax re d by using the hapter 5 3 of 20 (12 complete) ar with 100 containers of ink (weighted average cost of $9.40 each, FIFO cost of $9.10 each). During the year, expenses throughout the year, a total of $3,900. Unitil Copy Centre's income statement-excluding the effects poration subject to a 19% income tax. S-averag 0 Income Statement - X ze income bef Hollar.) S-averag Unitil Copy Centre Ltd. Income Statement For the Year Ended December 31, 2017 FIFO 74.260 6,214 Weighted- Average cost 14,260 $ 6,268 Sales revenue 14,260 6,214 8,046 3,900 $ Cost of goods sold Gross profit Operating expenses Net income before tax 7,992 3.900 8,046 3,900 4,146 4,092 $ 4,146 tax and (b) Print Done | method of inventory costing. he next question, Q Search or type URL Centre Ltd, uses laser printers. The company started the year with 100 containers of ink (weighted-avera sold 620 units for $23.00 each. The company paid operating expenses throughout the year, a total of $3,90 entory costing methods - is given. Unitil Copy Centre is a corporation subject to a 19% income tax. ck the icon to view the income statement.) e Uniti Copy Centre's income tax expense under the weighted-average cost and FIFO inventory costing meth te Unit Copy Centre's income tax expense using the weighted-average-cost and FIFO inventory costing metho Unitil Copy Centre Ltd. Income Statement For the Year Ended December 31, 2017 Weighted Average Cost ales revenue $ 14,260 $ Cost of goods sold 6,268 Bross profit $ 7,992 $ Operating expenses 3.900 Net income before tax 4,092 $ Income tax expense FIFO 14,260 6,214 8.046 3.900 Which method would you select to (a) maximize income before tax and (b) minimize income tax expense? a) The income before thesis maximized by using the bthod of inventory costing. FIFO The income taxes are minimized by using the weighted average cost of inventory costing Enter any number in the edit fields and then continue to the next question. esc Q Search or type URL 4 oral 6 estion: 4 pts copy Centre Ltd, uses laser printers. The company started the year with 100 containers of ink (weighted average und sold 620 units for $23.00 each. The company paid operating expenses throughout the year, a total of $3,900. nventory costing methods- is given. Unitil Copy Centre is a corporation subject to a 19% income tax. Click the icon to view the income statement.) pute Unitil Copy Centre's income tax expense under the weighted average cost and FIFO inventory costing methods pute Unitil Copy Centre's income tax expense using the weighted average cost and FIFO inventory costing methods. Unitil Copy Centre Ltd. Income Statement For the Year Ended December 31, 2017 Weighted Average Cost FIFO Sales revenue $ 14,260 $ 14,260 Cost of goods sold 6,268 6,214 Gross profit 7,992 $ 8,046 Operating expenses 3,900 3,900 Net Income before tax 4,092 $ 4,146 Income tax expense Which method would you select to (a) maximize income before tax and (b) minimize income tax expense? (a) The income before taxes is maximized by using the method of inventory costing. (b) The income taxes are minimized by using the othod of inventory costing. Enter any number in the edit fields and then FIFO weighted average-cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts