Question: H E D B A E11-1 CS Lewis Company had the following transactions involving notes payable. July 1, 2012 Borrows $50,000 from Fourth National Bank

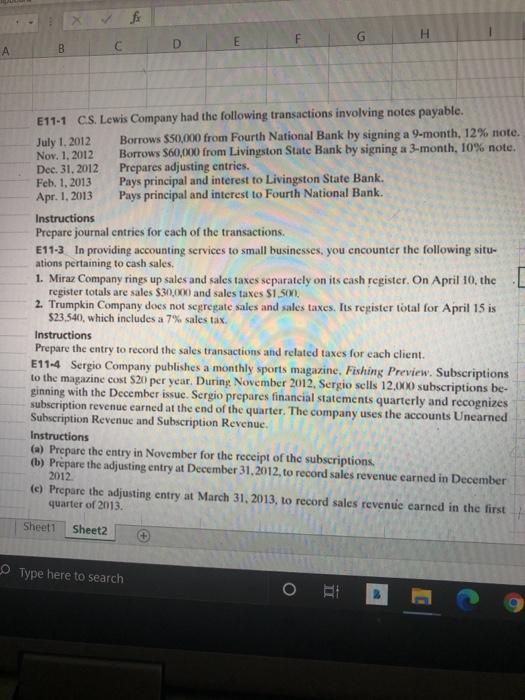

H E D B A E11-1 CS Lewis Company had the following transactions involving notes payable. July 1, 2012 Borrows $50,000 from Fourth National Bank by signing a 9-month, 12% note. Nov. 1, 2012 Borrows $60,000 from Livingston State Bank by signing a 3-month, 10% note. Dec 31, 2012 Prepares adjusting entries. Feb 1, 2013 Pays principal and interest to Livingston State Bank. Apr 1, 2013 Pays principal and interest to Fourth National Bank. Instructions Prepare journal entries for each of the transactions E11-3 In providing accounting services to small businesses, you cncounter the following situ- 1. Miraz Company rings up sales and sales taxes separately on its cash register. On April 10, the register totals are sales $30.000 and sales taxes $1.500. 2. Trumpkin Company does not segregate sales and sales taxes. Its register total for April 15 is $23.540, which includes a 7% sales tax. Instructions Prepare the entry to record the sales transactions and related taxes for each client. E11-4 Sergio Company publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $20) per year. During November 2012. Sergio sells 12,000 subscriptions be- ginning with the December issue. Sergio prepares financial statements quarterly and recognizes subscription revenue earned at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. Instructions (a) Prepare the entry in November for the receipt of the subscriptions (b) Prepare the adjusting entry at December 31, 2012, to record sales revenue earned in December te) Prepare the adjusting entry at March 31, 2013, to record sales revenue carned in the first quarter of 2013. 2012 Sheet1 Sheet2 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts