Question: h05/06: Homework Problems - Interest Rates and Time Value Part II The prices of long-term bonds declinu v whenever interest rates rise. Because interest rates

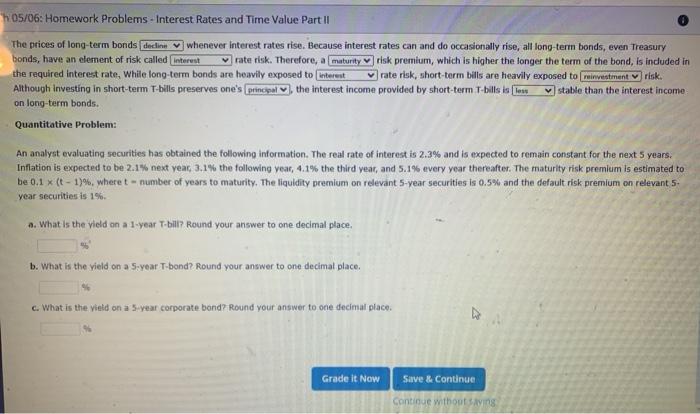

h05/06: Homework Problems - Interest Rates and Time Value Part II The prices of long-term bonds declinu v whenever interest rates rise. Because interest rates can and do occasionally rise, all long-term bonds, even Treasury bonds, have an element of risk called interest vrate risk. Therefore, a maturity risk premium, which is higher the longer the term of the bond, is included in the required interest rate, While long-term bands are heavily exposed to interest rate risk, short-term bills are heavily exposed to investment risk. Although investing in short-term T-bills preserves one's principal ), the interest income provided by short-term T-bills is Tess y stable than the interest income on long-term bonds. Quantitative Problem: An analyst evaluating securities has obtained the following information. The real rate of interest is 2.3% and is expected to remain constant for the next 5 years. Inflation is expected to be 2.1% next year, 3.1% the following year, 4.1% the third year, and 5.1% every year thereafter. The maturity risk premium is estimated to be 0.1 * (t-13%, wheret - number of years to maturity. The liquidity premium on relevant 5-year securities is 0.5% and the default risk premium on relevants- year securities is 1%. a. What is the vield on a 1-year T-bill? Round your answer to one decimal place. b. What is the yield on a 5-year T-bond? Round your answer to one decimal place. c. What is the yield on a 5-year corporate bond? Round your answer to one decimal place. Grade it Now Save & Continue Continue without sving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts