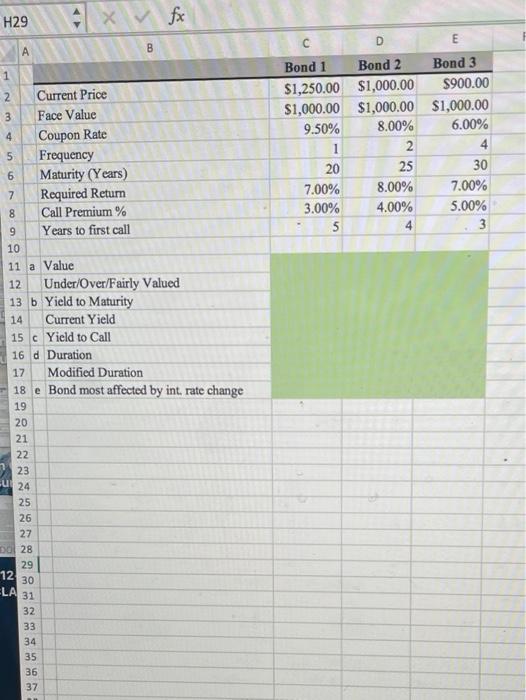

Question: H29 x fx D E A B 1 Bond 1 Bond 2 Bond 3 $1,250.00 $1,000.00 $900.00 $1,000.00 $1,000.00 $1,000.00 9.50% 8.00% 6.00% 1 2

H29 x fx D E A B 1 Bond 1 Bond 2 Bond 3 $1,250.00 $1,000.00 $900.00 $1,000.00 $1,000.00 $1,000.00 9.50% 8.00% 6.00% 1 2 20 25 30 8.00% 7.00% 7.00% 3.00% 5 4.00% 5.00% 4 3 2 Current Price 3 Face Value 4 Coupon Rate 5 Frequency 6 Maturity (Years) 7 Required Return 8 Call Premium % 9 Years to first call 10 11 a Value 12 Under/Over/Fairly Valued 13 b Yield to Maturity Current Yield 15 c Yield to Call 16 d Duration Modified Duration 18 e Bond most affected by int. rate change 19 14 17 20 21 22 23 u 24 NNN 27 Do 28 29 12 30 LA 31 32 33 34 35 36 37 H29 x fx D E A B 1 Bond 1 Bond 2 Bond 3 $1,250.00 $1,000.00 $900.00 $1,000.00 $1,000.00 $1,000.00 9.50% 8.00% 6.00% 1 2 20 25 30 8.00% 7.00% 7.00% 3.00% 5 4.00% 5.00% 4 3 2 Current Price 3 Face Value 4 Coupon Rate 5 Frequency 6 Maturity (Years) 7 Required Return 8 Call Premium % 9 Years to first call 10 11 a Value 12 Under/Over/Fairly Valued 13 b Yield to Maturity Current Yield 15 c Yield to Call 16 d Duration Modified Duration 18 e Bond most affected by int. rate change 19 14 17 20 21 22 23 u 24 NNN 27 Do 28 29 12 30 LA 31 32 33 34 35 36 37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts