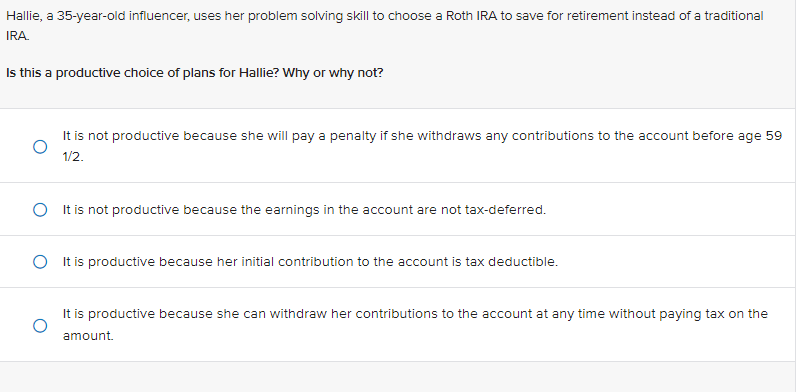

Question: Hallie, a 35-year-old influencer, uses her problem solving skill to choose a Roth IRA to save for retirement instead of a traditional IRA. Is this

Hallie, a 35-year-old influencer, uses her problem solving skill to choose a Roth IRA to save for retirement instead of a traditional IRA. Is this a productive choice of plans for Hallie? Why or why not? It is not productive because she will pay a penalty if she withdraws any contributions to the account before age 5 1/2 It is not productive because the earnings in the account are not tax-deferred. It is productive because her initial contribution to the account is tax deductible. It is productive because she can withdraw her contributions to the account at any time without paying tax on the amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock