Question: Hamilton Processing Company uses a weighted average process cost system and manufactures a single product-an industrial carpet shampoo and cleaner used by many universities. The

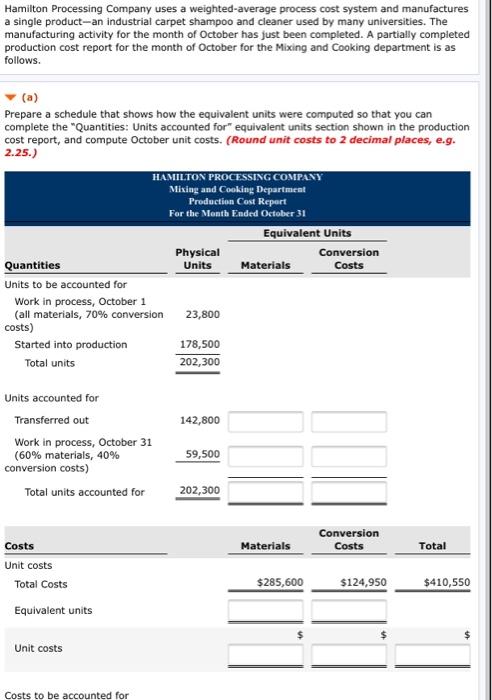

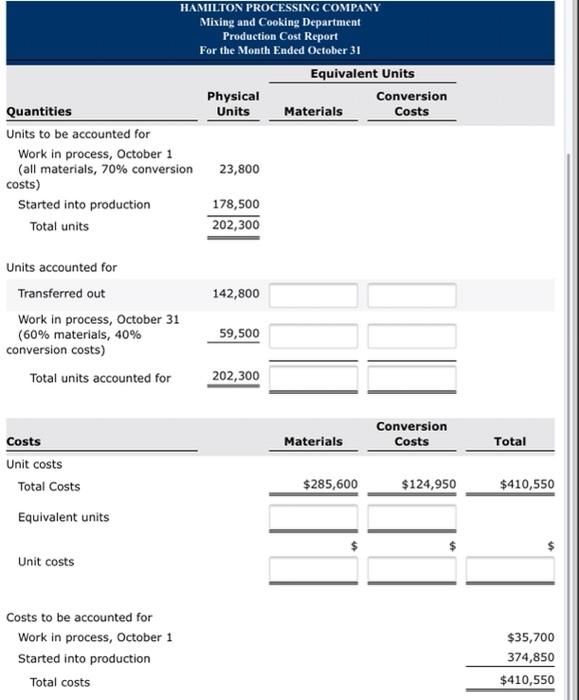

Hamilton Processing Company uses a weighted average process cost system and manufactures a single product-an industrial carpet shampoo and cleaner used by many universities. The manufacturing activity for the month of October has just been completed. A partially completed production cost report for the month of October for the Mixing and Cooking department is as follows. Prepare a schedule that shows how the equivalent units were computed so that you can complete the "Quantities: Units accounted for equivalent units section shown in the production cost report, and compute October unit costs. (Round unit costs to 2 decimal places, e.g. 2.25.) HAMILTON PROCESSING COMPANY Mixing and Cooking Department Production Cost Report For the Month Ended October 31 Equivalent Units Physical Conversion Quantities Units Materials Costs Units to be accounted for Work in process, October 1 (all materials, 70% conversion 23,800 costs) Started into production 178,500 Total units 202,300 142,800 Units accounted for Transferred out Work in process, October 31 (60% materials, 40% conversion costs) Total units accounted for 59,500 202,300 Materials Conversion Costs Total Costs Unit costs Total Costs Equivalent units $285,600 $124,950 $410,550 Unit costs Costs to be accounted for HAMILTON PROCESSING COMPANY Mixing and Cooking Department Production Cost Report For the Month Ended October 31 Equivalent Units Physical Conversion Quantities Units Materials Costs Units to be accounted for Work in process, October 1 (all materials, 70% conversion 23,800 costs) Started into production 178,500 Total units 202,300 142,800 Units accounted for Transferred out Work in process, October 31 (60% materials, 40% conversion costs) Total units accounted for 59,500 202,300 Conversion Costs Materials Total Costs Unit costs Total Costs Equivalent units $285,600 $124,950 $410,550 Unit costs Costs to be accounted for Work in process, October 1 Started into production Total costs $35,700 374,850 $410,550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts