Question: Hamilton's, a home improvement store chain, reported these summarized figures: Click the icon to view the income statement) (Click the icon to view the balance

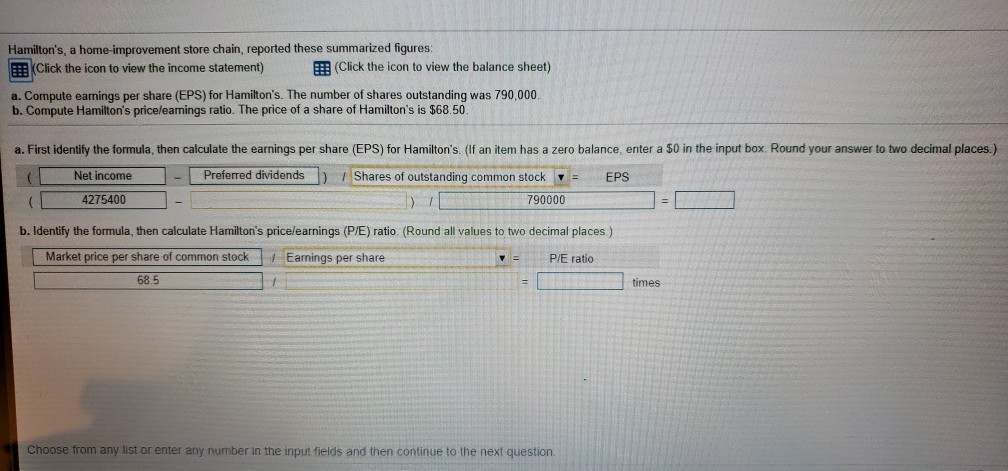

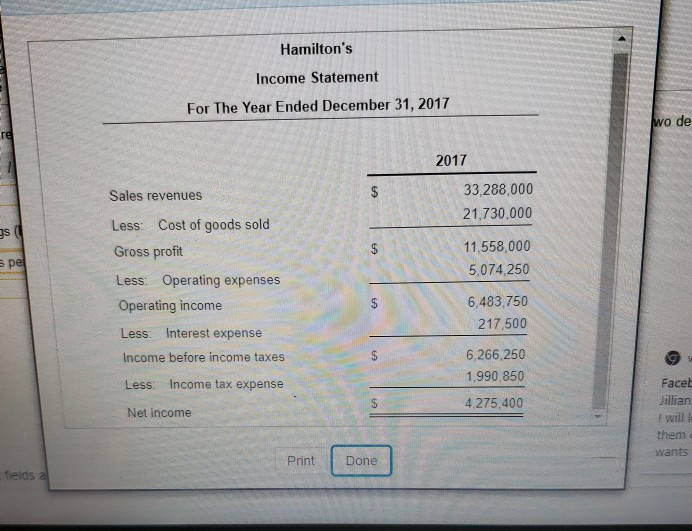

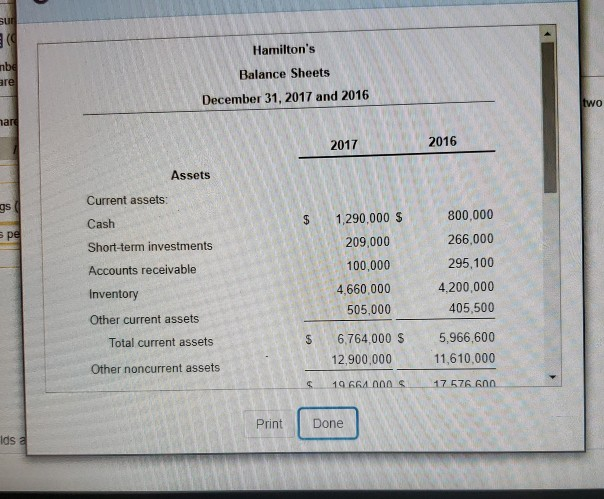

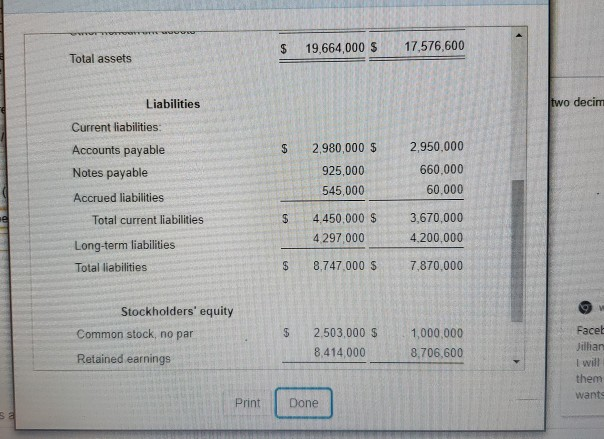

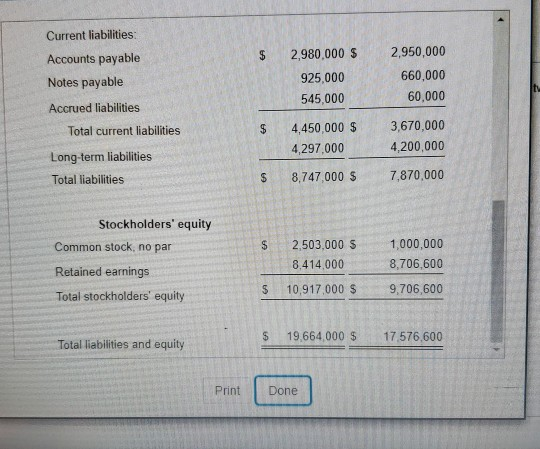

Hamilton's, a home improvement store chain, reported these summarized figures: Click the icon to view the income statement) (Click the icon to view the balance sheet) a. Compute earnings per share (EPS) for Hamilton's. The number of shares outstanding was 790,000 b. Compute Hamilton's price/earnings ratio. The price of a share of Hamilton's is $68.50. a. First identify the formula, then calculate the earnings per share (EPS) for Hamilton's. (If an item has a zero balance, enter a $0 in the input box. Round your answer to two decimal places.) Net income - Preferred dividends ) 7 Shares of outstanding common stock = EPS 4275400 790000 b. Identify the formula, then calculate Hamilton's pricelearnings (P/E) ratio (Round all values to two decimal places) Market price per share of common stock Earnings per share P/E ratio 68.5 times Choose from any list or enter any number in the input fields and then continue to the next question Hamilton's Income Statement For The Year Ended December 31, 2017 wo de 2017 33,288,000 21,730,000 Sales revenues Less: Cost of goods sold Gross profit Less: Operating expenses Operating income 5 11.558,000 5,074,250 A 6,483,750 217,500 Less Interest expense Income before income taxes 9 . Less: Income tax expense 6,266,250 1.990,850 4,275,400 Facet Jillian Net income them wants Print Done Tields a Hamilton's Balance Sheets December 31, 2017 and 2016 two 2017 2016 Assets Current assets: Cash Short-term investments Accounts receivable Inventory Other current assets Total current assets 1,290,000 $ 209,000 100,000 4.660.000 505.000 800,000 266,000 295,100 4,200,000 405,500 $ Other noncurrent assets 6.764,000 $ 12,900,000 19664 000 5,966,600 11,610,000 17 576.600 Print Done $ 19,664,000 $ 17.576,600 Total assets Liabilities two decim Current liabilities: Accounts payable Notes payable $ 2,980,000 $ 925,000 545,000 2,950,000 660,000 60.000 $ Accrued liabilities Total current liabilities Long-term liabilities Total liabilities 4.450,000 $ 4297 000 3,670,000 4,200,000 $ 8,747 000 $ 7,870,000 Stockholders' equity Common stock, no par $ 2.503.000 $ 8.414,000 1,000,000 8,706,600 Retained earnings Facet Jilhan I will them wants Print Done $ Current liabilities Accounts payable Notes payable Accrued liabilities Total current liabilities 2,980,000 $ 925,000 545,000 2,950,000 660,000 60,000 4,450,000 $ 4,297,000 3,670,000 4,200,000 Long-term liabilities Total liabilities 8,747,000 $ 7,870,000 Stockholders' equity Common stock, no par $ 2,503,000 S 8.414,000 1,000,000 8,706,600 Retained earnings Total stockholders' equity $ 10,917,000 $ 9,706,600 $ 19,664 000 $ 17576,600 Total liabilities and equity Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts