Question: Haming detain: Lumedum 8 3 ? 2 5 , 4 : 4 2 P M Question 7 of 1 2 . Mark itemized his deductions

Haming detain: Lumedum

:

Question of

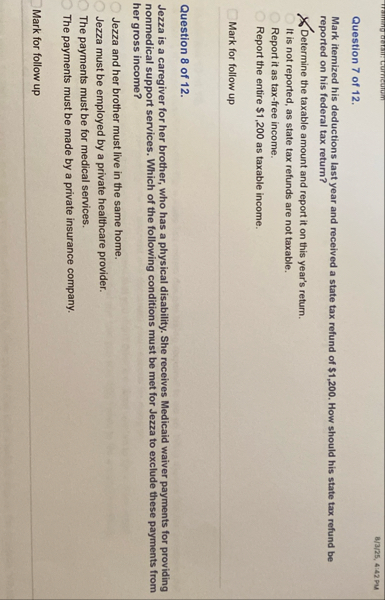

Mark itemized his deductions last year and received a state tax refund of $ How should his state tax refund be reported on his federal tax return?

Determine the taxable amount and report it on this year's return.

It is not reported, as state tax refunds are not taxable.

Report it as taxfree income.

Report the entire $ as taxable income.

Mark for follow up

Question of

Jezza is a caregiver for her brother, who has a physical disability. She receives Medicaid waiver payments for providing nonmedical support services. Which of the following conditions must be met for Jezza to exclude these payments from her gross income?

Jezza and her brother must live in the same home.

Jezza must be employed by a private healthcare provider.

The payments must be for medical services.

The payments must be made by a private insurance company.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock