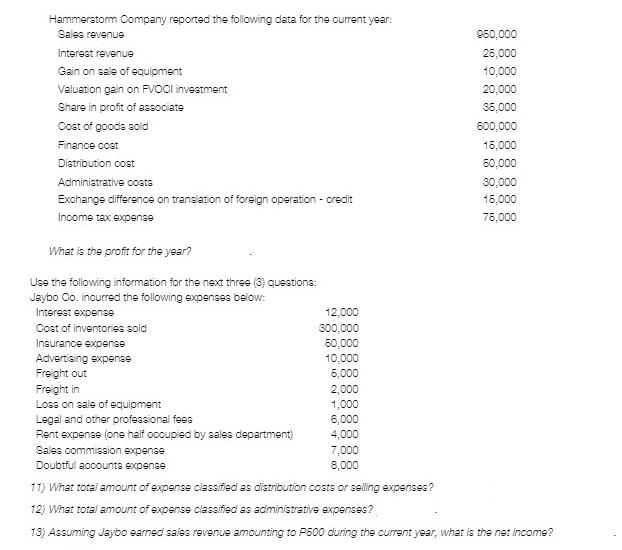

Question: Hammerstorm Company reported the following data for the current year: Sales revenue Interest revenue Gain on sale of equipment Valuation gain on FVOCI investment

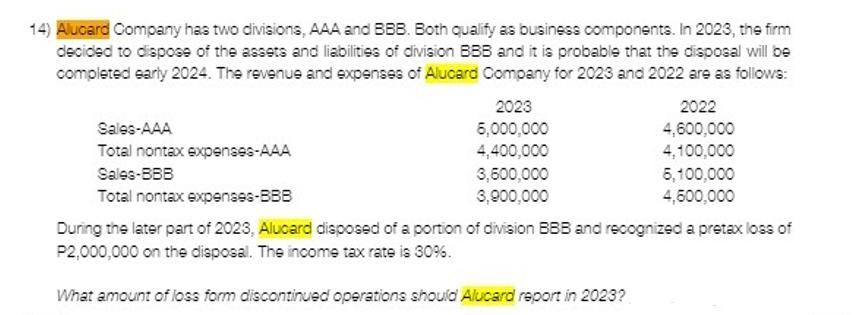

Hammerstorm Company reported the following data for the current year: Sales revenue Interest revenue Gain on sale of equipment Valuation gain on FVOCI investment Share in profit of associate Cost of goods sold Finance cost Distribution cost Administrative costs Exchange difference on translation of foreign operation - credit Income tax expense What is the profit for the year? Use the following information for the next three (3) questions: Jaybo Co. incurred the following expenses below: Interest expense Cost of inventories sold Insurance expense Advertising expense Freight out Freight in Loss on sale of equipment Legal and other professional fees Rent expense (one half occupied by sales department) Sales commission expense Doubtful accounts expense 12,000 300,000 50,000 10,000 5,000 2,000 1,000 6,000 4,000 7,000 8,000 950,000 25,000 10,000 20,000 36,000 600,000 15,000 60,000 30,000 15,000 75,000 11) What total amount of expense classified as distribution costs or selling expenses? 12) What total amount of expense classified as administrative expenses? 13) Assuming Jaybo earned sales revenue amounting to P500 during the current year, what is the net income? 14) Alucard Company has two divisions, AAA and BBB. Both qualify as business components. In 2023, the firm decided to dispose of the assets and liabilities of division BBB and it is probable that the disposal will be completed early 2024. The revenue and expenses of Alucard Company for 2023 and 2022 are as follows: 2023 6,000,000 4,400,000 2022 4,600,000 4,100,000 Sales-AAA Total nontax expenses-AAA Sales-BBB Total nontax expenses-BBB During the later part of 2023, Alucard disposed of a portion of division BBB and recognized a pretax loss of P2,000,000 on the disposal. The income tax rate is 30%. What amount of loss form discontinued operations should Alucard report in 2023? 3,600,000 3,900,000 6,100,000 4,500,000

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

I see that there are multiple questions present here but these appear to be from an accounting exercise related to calculating profits distribution costs selling expenses and discontinued operations S... View full answer

Get step-by-step solutions from verified subject matter experts