Question: hand calculations please Problem #1 (5 marks) Green Island Construction has a cost of equity of 11% and a cost of debt of 7%. The

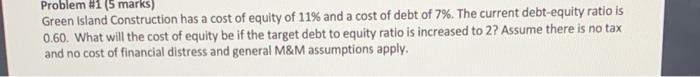

Problem #1 (5 marks) Green Island Construction has a cost of equity of 11% and a cost of debt of 7%. The current debt-equity ratio is 0.60. What will the cost of equity be if the target debt to equity ratio is increased to 2? Assume there is no tax and no cost of financial distress and general M&M assumptions apply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts