Question: hand work required please Question 2: Smith purchased a non-current asset on 1 January 20X1 at a cost of $50,000. At that date, the asset

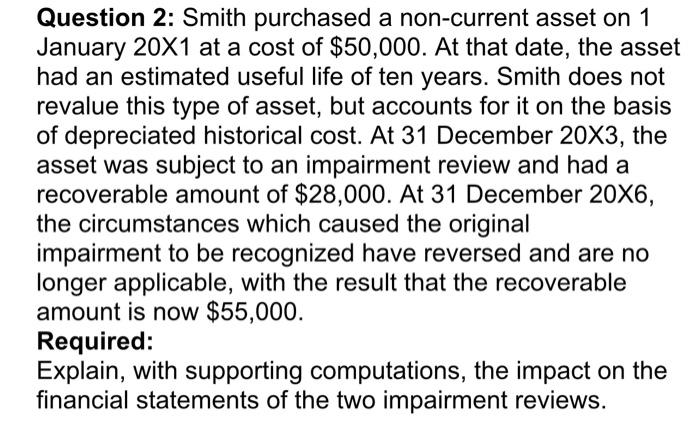

Question 2: Smith purchased a non-current asset on 1 January 20X1 at a cost of $50,000. At that date, the asset had an estimated useful life of ten years. Smith does not revalue this type of asset, but accounts for it on the basis of depreciated historical cost. At 31 December 20X3, the asset was subject to an impairment review and had a recoverable amount of $28,000. At 31 December 20X6, the circumstances which caused the original impairment to be recognized have reversed and are no longer applicable, with the result that the recoverable amount is now $55,000. Required: Explain, with supporting computations, the impact on the financial statements of the two impairment reviews

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts