Question: hand written answer please ! Question:02: 04 In 2017, ABC Company started a construction job with a contract price of Tk.1, 800,000. The job was

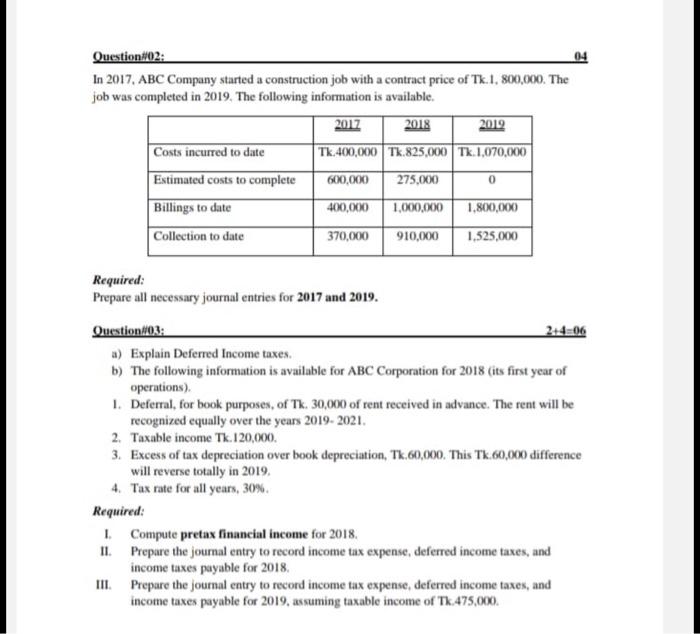

Question:02: 04 In 2017, ABC Company started a construction job with a contract price of Tk.1, 800,000. The job was completed in 2019. The following information is available. 2017 2018 2019 Costs incurred to date Tk.400,000 Tk 825,000 Tk. 1,070,000 Estimated costs to complete 600,000 275,000 Billings to date 400,000 1,000,000 1,800,000 Collection to date 370,000 910,000 1.525,000 0 Required: Prepare all necessary journal entries for 2017 and 2019. Question#03: 244-06 a) Explain Deferred Income taxes. b) The following information is available for ABC Corporation for 2018 (its first year of operations) 1. Deferral, for book purposes of Tk. 30,000 of rent received in advance. The rent will be recognized equally over the years 2019-2021. 2. Taxable income Tk. 120,000. 3. Excess of tax depreciation over book depreciation, Tk,60,000. This Tk 60,000 difference will reverse totally in 2019, 4. Tux rate for all years, 30%. Required: 1 Compute pretax financial income for 2018. II. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2018, m. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019, assuming taxable income of Tk 475,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts