Question: Handout - Inventory Cost and Cost Flow Methods Example #1 - Ending Inventory Cost Lopez Company counted its ending inventory on March 31, 2019. None

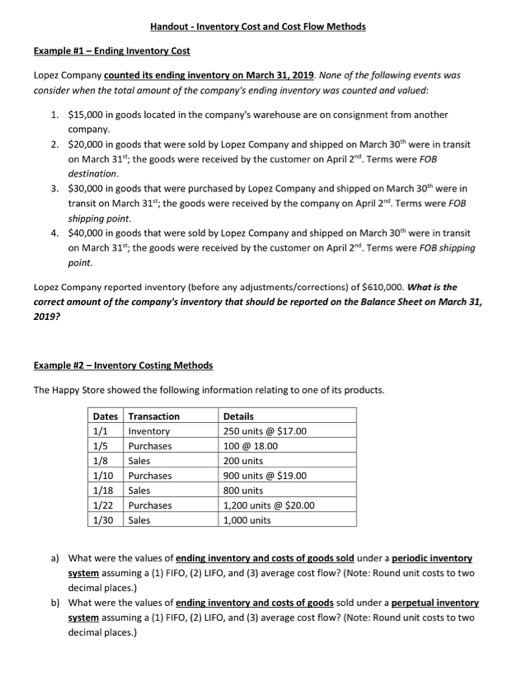

Handout - Inventory Cost and Cost Flow Methods Example #1 - Ending Inventory Cost Lopez Company counted its ending inventory on March 31, 2019. None of the following events was consider when the total amount of the company's ending inventory was counted and valued: 1. $15,000 in goods located in the company's warehouse are on consignment from another company. 2. $20,000 in goods that were sold by Lopez Company and shipped on March 30" were in transit on March 31", the goods were received by the customer on April 2. Terms were FOB destination. 3. $30,000 in goods that were purchased by Lopez Company and shipped on March 30" were in transit on March 31", the goods were received by the company on April 2". Terms were FOB shipping point 4. $40,000 in goods that were sold by Lopez Company and shipped on March 30 were in transit on March 31", the goods were received by the customer on April 2". Terms were FOB shipping point. Lopez Company reported inventory (before any adjustments/corrections) of $610,000. What is the correct amount of the company's inventory that should be reported on the Balance Sheet on March 31, 2019? Example #2 - Inventory Costing Methods The Happy Store showed the following information relating to one of its products, Dates 1/1 1/5 1/8 1/10 1/18 1/22 1/30 Transaction Inventory Purchases Sales Purchases Sales Purchases Sales Details 250 units @ $17.00 100 @ 18.00 200 units 900 units @ $19.00 800 units 1,200 units @ $20.00 1,000 units a) What were the values of ending inventory and costs of goods sold under a periodic Inventory system assuming a (1) FIFO, (2) LIFO, and (3) average cost flow? (Note: Round unit costs to two decimal places.) b) What were the values of ending inventory and costs of goods sold under a perpetual inventory system assuming a (1) FIFO, (2) LIFO, and (3) average cost flow? (Note: Round unit costs to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts