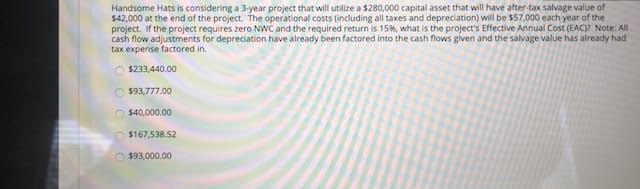

Question: Handsome Hats is considering a 3.year project that will utilize a 5280,000 capital asset that will have after tax salvage value of $42.000 at the

Handsome Hats is considering a 3.year project that will utilize a 5280,000 capital asset that will have after tax salvage value of $42.000 at the end of the project. The operational costs (including all taxes and depreciation) will be 557,000 each year of the project. If the project requires zero NWC and the required return is 15%, what is the project's Effective Annual Cost (EAC)2 Note: All cash flow adjustments for depreciation have already been factored into the cash flows given and the salvage value has already had tax expense factored in $233.440.00 $93.777.00 540,000.00 $167,538,52 $93,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts