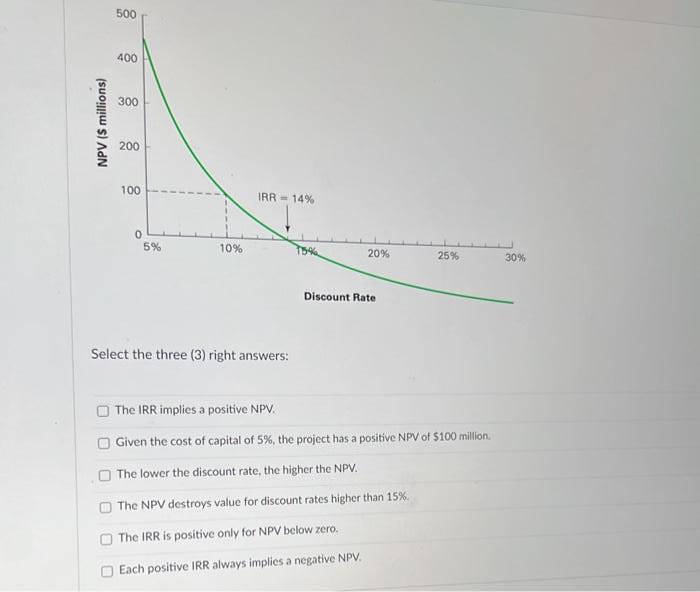

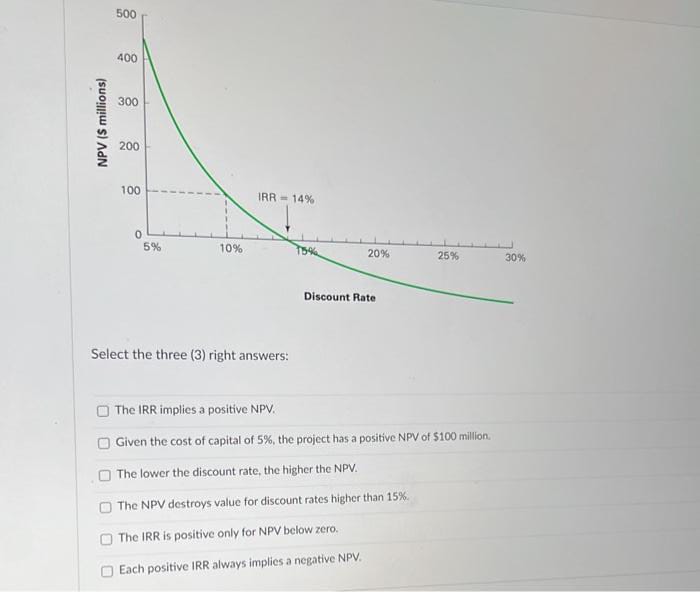

Question: Handwritten solution not required correct answer will get instant upvote. 500 40 300 NPV ($ millions) 200 100 IRA = 14% 5% 10% 20% 25%

Handwritten solution not required correct answer will get instant upvote.

500 40 300 NPV ($ millions) 200 100 IRA = 14% 5% 10% 20% 25% 30% Discount Rate Select the three (3) right answers: The IRR implies a positive NPV. ()Given the cost of capital of 5%, the project has a positive NPV of $100 million. )The lower the discount rate, the higher the NPV. )The NPV destroys value for discount rates higher than 15%. The IRR is positive only for NPV below zero. )Each positive IRR always implies a negative NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts