Question: happy easter do all three please stay safe, stay inside Turner Corporation acquired two inventory items at a lump-sum cost of $120,000. The acquisition included

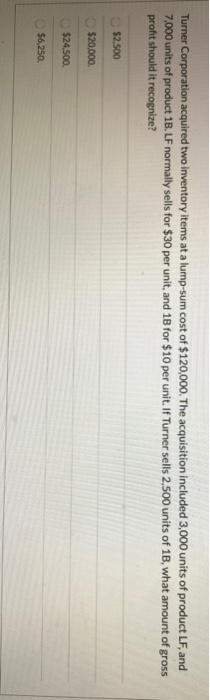

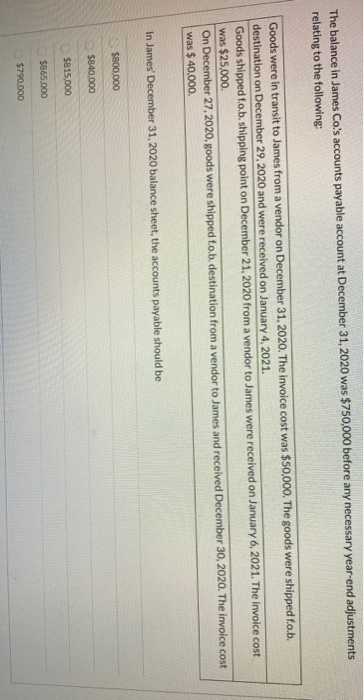

Turner Corporation acquired two inventory items at a lump-sum cost of $120,000. The acquisition included 3,000 units of product LF, and 7,000 units of product 1B.LF normally sells for $30 per unit, and 1B for $10 per unit. If Turner sells 2,500 units of 1B, what amount of gross profit should it recognize? $2,500 $20,000 $24,500 $6.250 The balance in James Co's accounts payable account at December 31, 2020 was $750,000 before any necessary year-end adjustments relating to the following: Goods were in transit to James from a vendor on December 31, 2020. The invoice cost was $50,000. The goods were shipped fo.b. destination on December 29, 2020 and were received on January 4, 2021. Goods shipped f.o.b. shipping point on December 21, 2020 from a vendor to James were received on January 6, 2021. The invoice cost was $25,000 On December 27, 2020, goods were shipped to.b. destination from a vendor to James and received December 30, 2020. The invoice cost was $ 40,000 In James' December 31, 2020 balance sheet, the accounts payable should be $800,000 $840,000 $815,000 $865.000 $790.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts