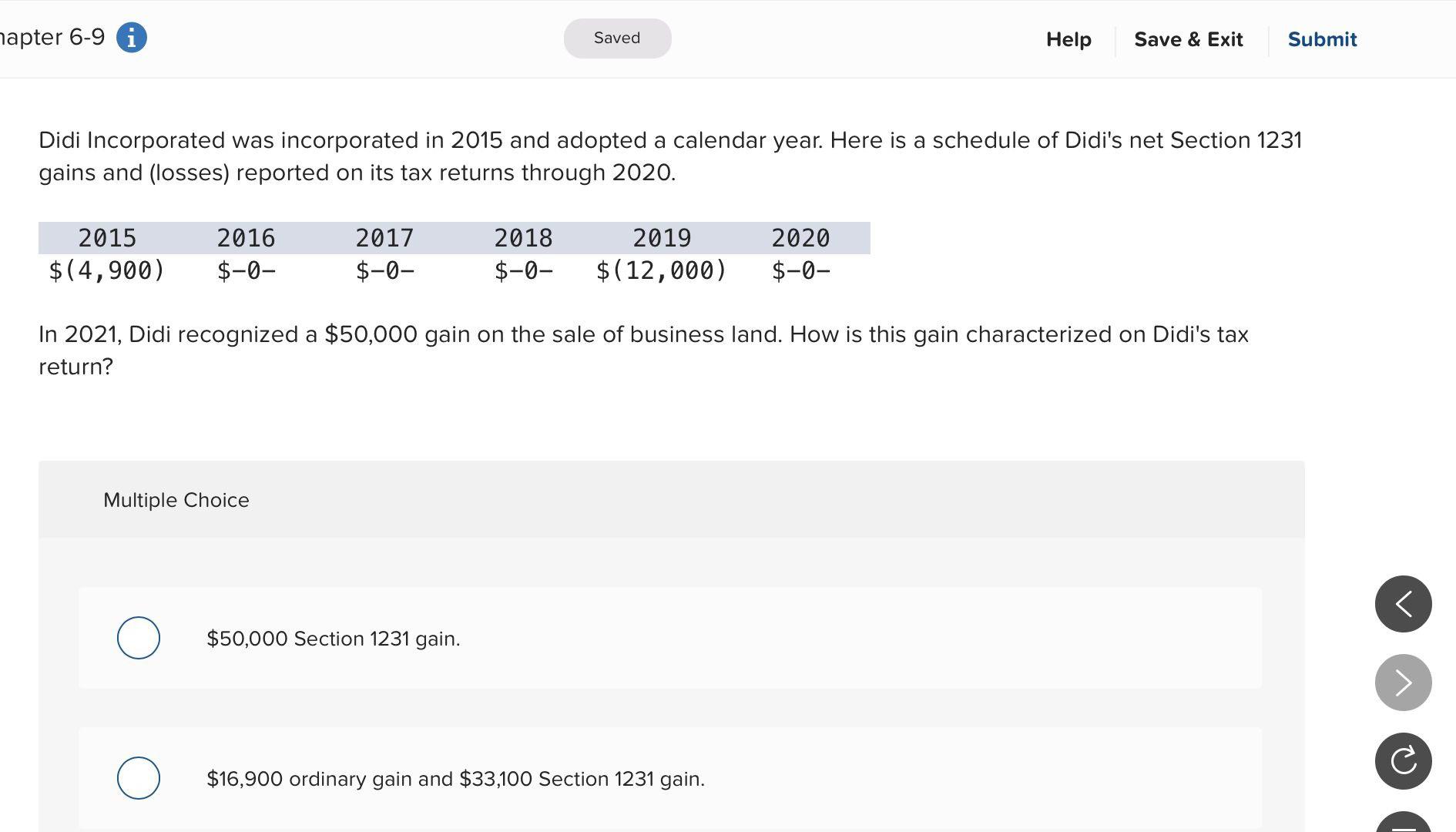

Question: hapter 6-9 Saved Help Save & Exit Submit Didi Incorporated was incorporated in 2015 and adopted a calendar year. Here is a schedule of Didi's

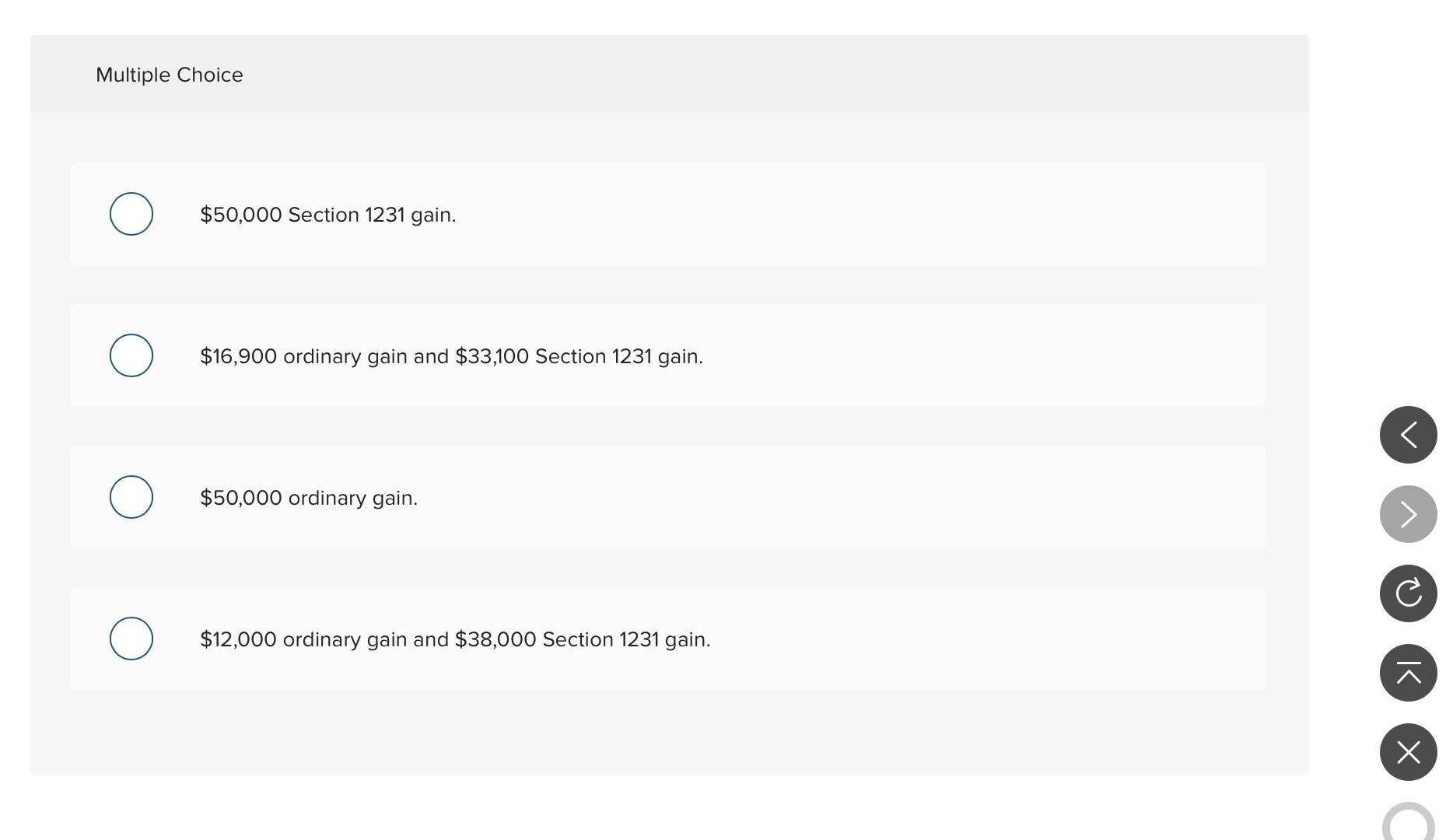

hapter 6-9 Saved Help Save & Exit Submit Didi Incorporated was incorporated in 2015 and adopted a calendar year. Here is a schedule of Didi's net Section 1231 gains and (losses) reported on its tax returns through 2020. 2015 $(4,900) 2016 $-0- 2017 $-0- 2018 $-0- 2019 $(12,000) 2020 $-0- In 2021, Didi recognized a $50,000 gain on the sale of business land. How is this gain characterized on Didi's tax return? Multiple Choice I X C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts