Question: Hard copy to be submitted in class (I do NOT need copies of the questions, only your answers). You must show your work for credit.

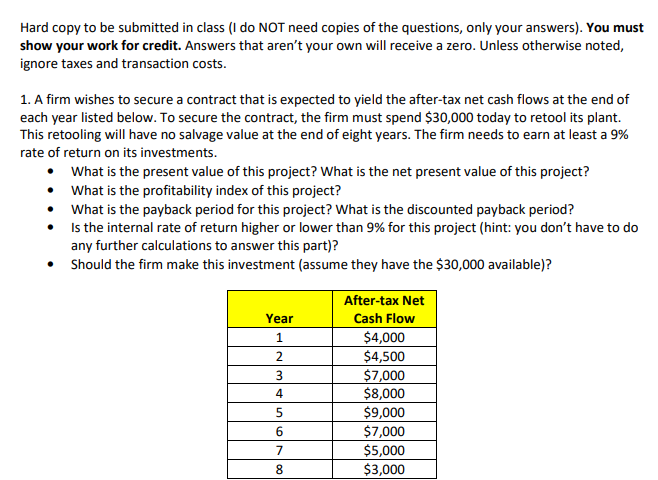

Hard copy to be submitted in class (I do NOT need copies of the questions, only your answers). You must show your work for credit. Answers that aren't your own will receive a zero. Unless otherwise noted, ignore taxes and transaction costs 1. A firm wishes to secure a contract that is expected to yield the after-tax net cash flows at the end of each year listed below. To secure the contract, the firm must spend $30,000 today to retool its plant. This retooling will have no salvage value at the end of eight years. The firm needs to earn at least a 996 rate of return on its investments What is the present value of this project? What is the net present value of this project? What is the profitability index of this project? What is the payback period for this project? What is the discounted payback period? is the internal rate of return higher or lower than 9% for this project (hint: you don't have to do any further calculations to answer this part)? Should the firm make this investment (assume they have the $30,000 available)? After-tax Net Cash Flow $4,000 $4,500 $7,000 $8,000 $9,000 $7,000 $5,000 $3,000 Year 4 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts