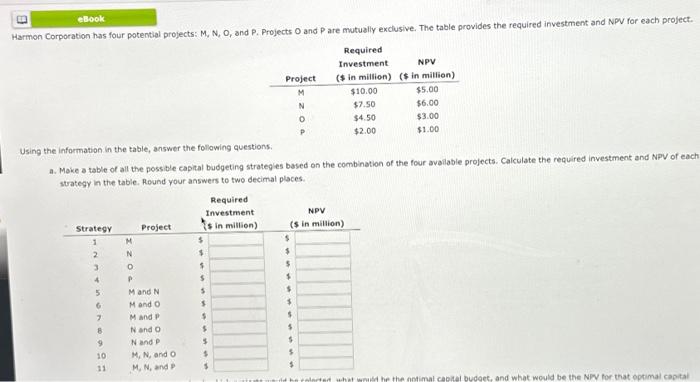

Question: Harmon Corporation has four potential projects: M,N,O, and P. Projects O and P are mutually exclusive. The table provides the required investment and NPV for

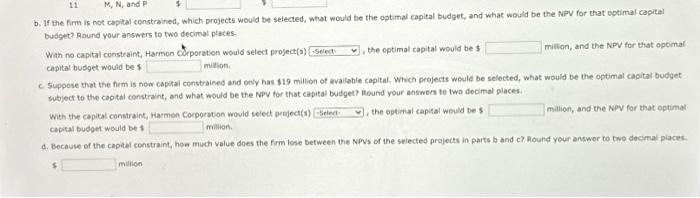

Harmon Corporation has four potential projects: M,N,O, and P. Projects O and P are mutually exclusive. The table provides the required investment and NPV for each project. Using the information in the table, answer the following questions: a. Moke a table of all the possible capital budgeting strategies based on the combination of the four available projects. Calculate the required investment and NPV of each strategy in the table. Round your answers to two decimal places. b. If the firm is not capital constrained, which projects would be seiected, what would be the optimal capital budget, and what would be the NPV for that optimal capital budget? Round your answers to two decimal places. Whth no capital constraint, Harmon Corporation would select project(s) , the optimal capital would be $ million, and the NPV for that optimal capital budget would be $ mition. c. Suppose that the firm is now capital constrained and only has $19 million of avalable capital. Which peojects weuld be selected, what would be the optimal capital budget subject to the capital constraint, and what would be the NPV for that capital budget? Round your answers to two decimal places. With the copital constraint, Harmon Corporotion wovid select project(s) , the optimal capital would be s million, and the NOV for that optimat capital budpet would be 5 million. d. Because of the captal constraint, hon much value does the firm lose between the Npvs of the selected projects in parts b and c ? hound your answer to twe decimal places. 5 milicen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts