Question: Harmony, Incorporated, sells a product for $110 per unit. Variable costs per unit are $33, and monthly fixed costs are $577,500. Required: a. What is

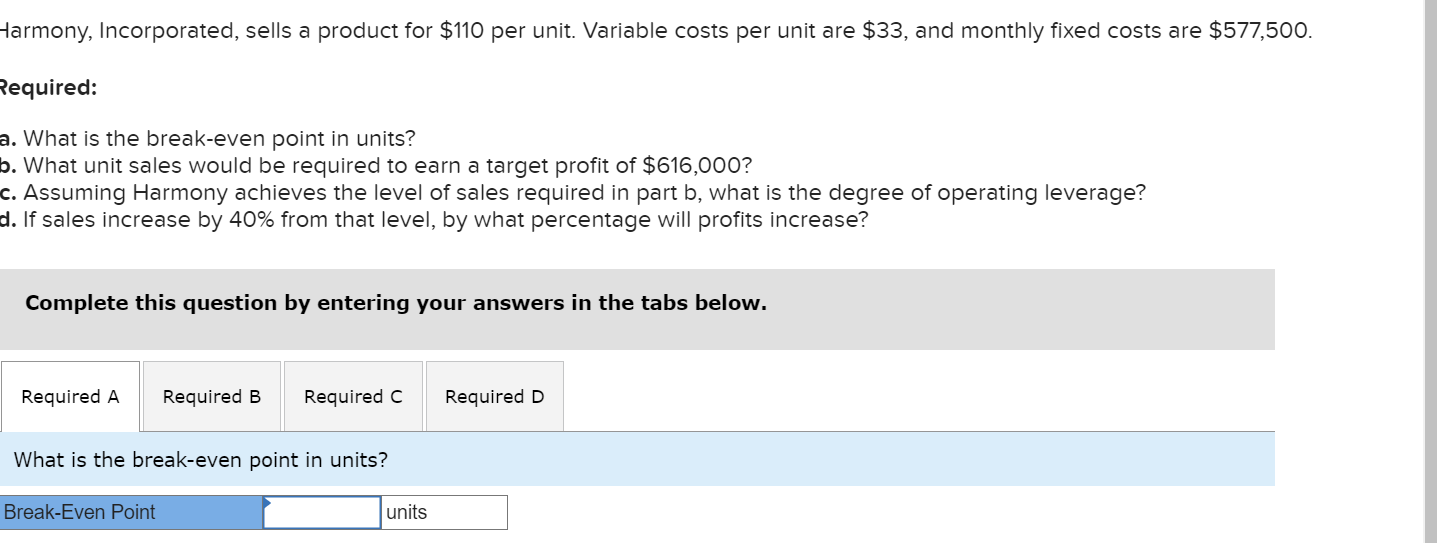

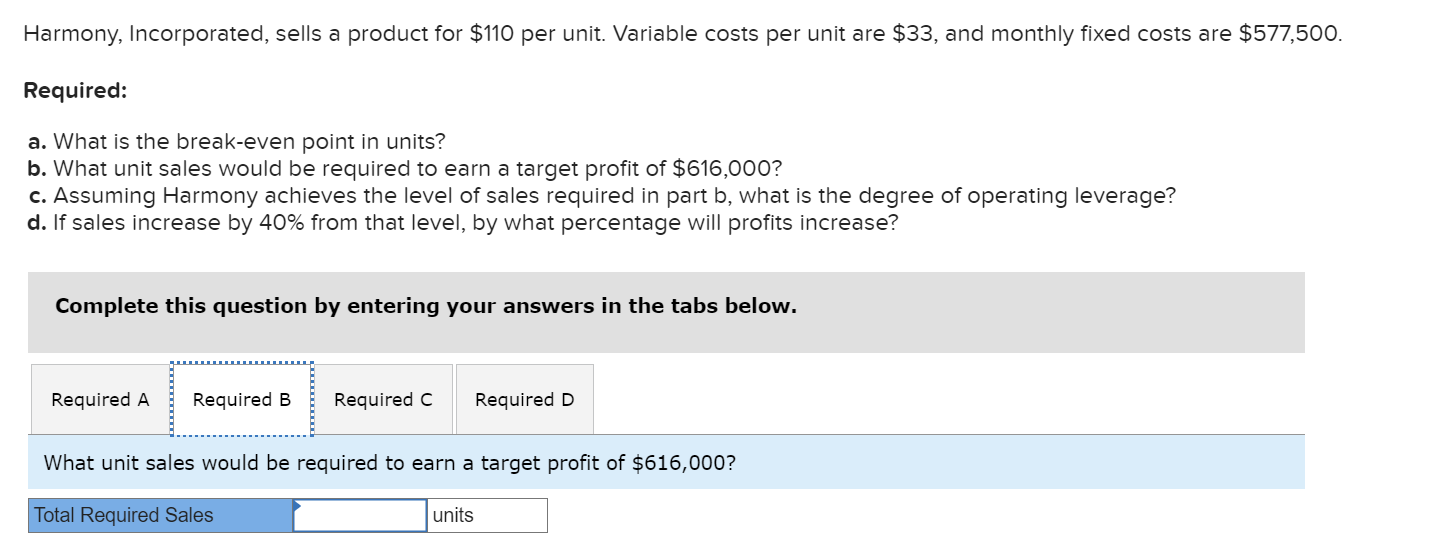

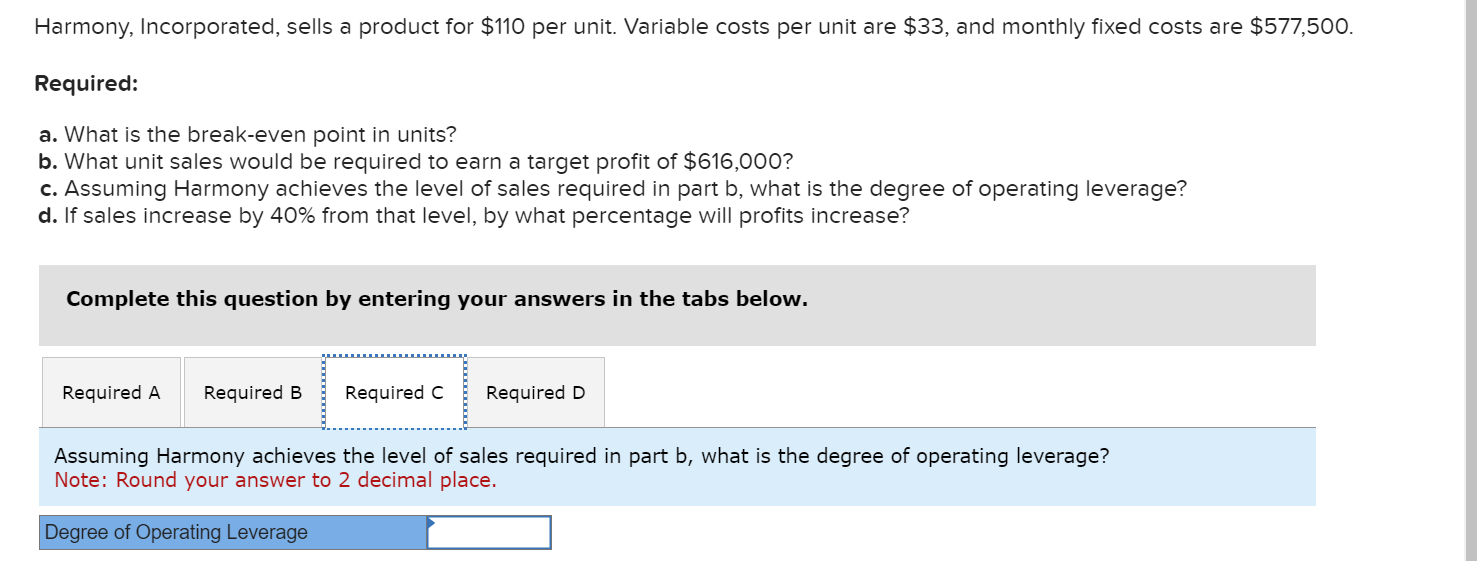

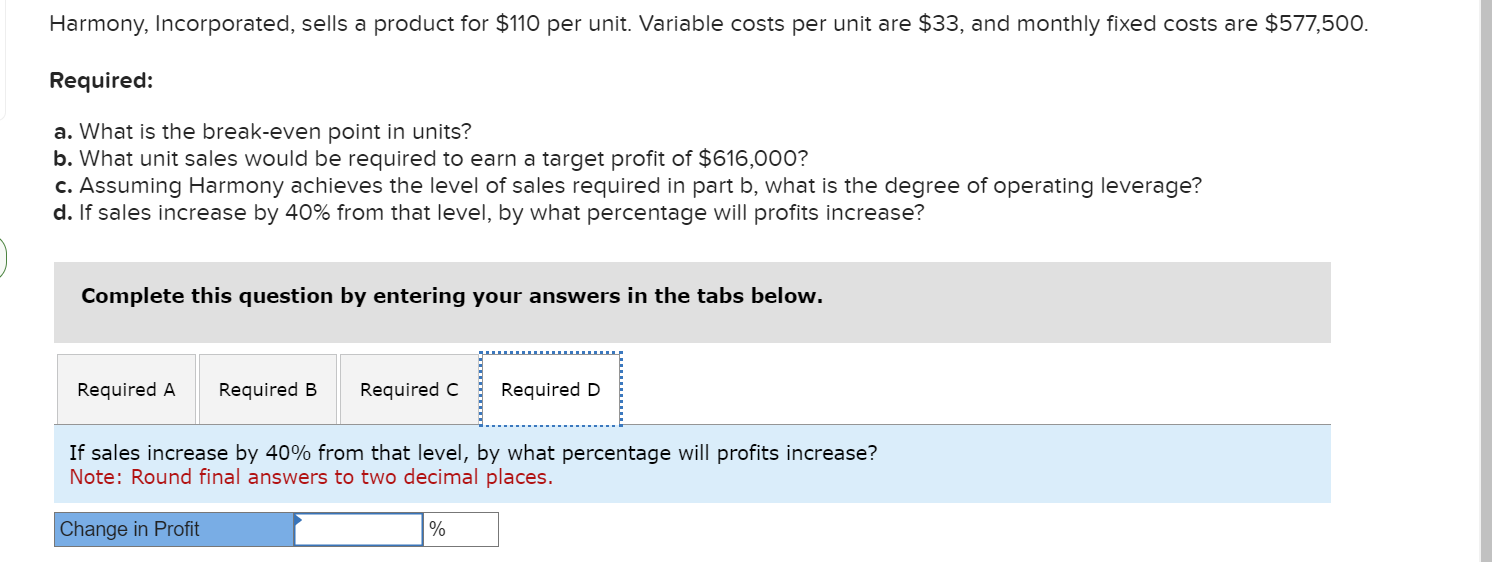

Harmony, Incorporated, sells a product for $110 per unit. Variable costs per unit are $33, and monthly fixed costs are $577,500. Required: a. What is the break-even point in units? b. What unit sales would be required to earn a target profit of $616,000 ? c. Assuming Harmony achieves the level of sales required in part b, what is the degree of operating leverage? d. If sales increase by 40% from that level, by what percentage will profits increase? Complete this question by entering your answers in the tabs below. What unit sales would be required to earn a target profit of $616,000 ? larmony, Incorporated, sells a product for $110 per unit. Variable costs per unit are $33, and monthly fixed costs are $577,500. equired: What is the break-even point in units? What unit sales would be required to earn a target profit of $616,000 ? Assuming Harmony achieves the level of sales required in part b, what is the degree of operating leverage? I. If sales increase by 40% from that level, by what percentage will profits increase? Complete this question by entering your answers in the tabs below. What is the break-even point in units? Harmony, Incorporated, sells a product for $110 per unit. Variable costs per unit are $33, and monthly fixed costs are $577,500. Required: a. What is the break-even point in units? b. What unit sales would be required to earn a target profit of $616,000 ? c. Assuming Harmony achieves the level of sales required in part b, what is the degree of operating leverage? d. If sales increase by 40% from that level, by what percentage will profits increase? Complete this question by entering your answers in the tabs below. Assuming Harmony achieves the level of sales required in part b, what is the degree of operating leverage? Note: Round your answer to 2 decimal place. Harmony, Incorporated, sells a product for $110 per unit. Variable costs per unit are $33, and monthly fixed costs are $577,500. Required: a. What is the break-even point in units? b. What unit sales would be required to earn a target profit of $616,000 ? c. Assuming Harmony achieves the level of sales required in part b, what is the degree of operating leverage? d. If sales increase by 40% from that level, by what percentage will profits increase? Complete this question by entering your answers in the tabs below. If sales increase by 40% from that level, by what percentage will profits increase? Note: Round final answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts