Question: Harold is a mechanical engineer and, while unemployed, invents a switching device for computer networks. He patents the device, but does not reduce it to

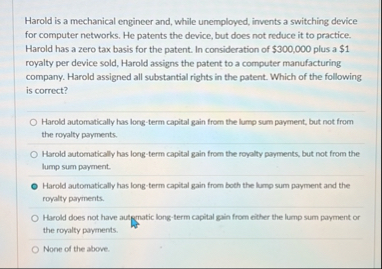

Harold is a mechanical engineer and, while unemployed, invents a switching device for computer networks. He patents the device, but does not reduce it to practice. Harold has a zero tax basis for the patent. In consideration of $ plus a $ royalty per device sold, Harold assigns the patent to a computer manufacturing company. Harold assigned all substantial rights in the patent. Which of the following is correct?

Harold automatically has longterm capital gain from the lump sum payment, but not from the royalty payments.

Harold automatically has longterm capital gain from the royalty payments, but not from the lump sum payment.

Harold automatically has longterm capital gain from both the lump sum payment and the royalty payments.

Harold does not have autgrnatic longterm capital gain from either the lump sum payment or the royalty payments.

None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock