Question: Harold MacGregor is considering buying stocks for the first time and is looking for a single company in which he'll make a major investment. He's

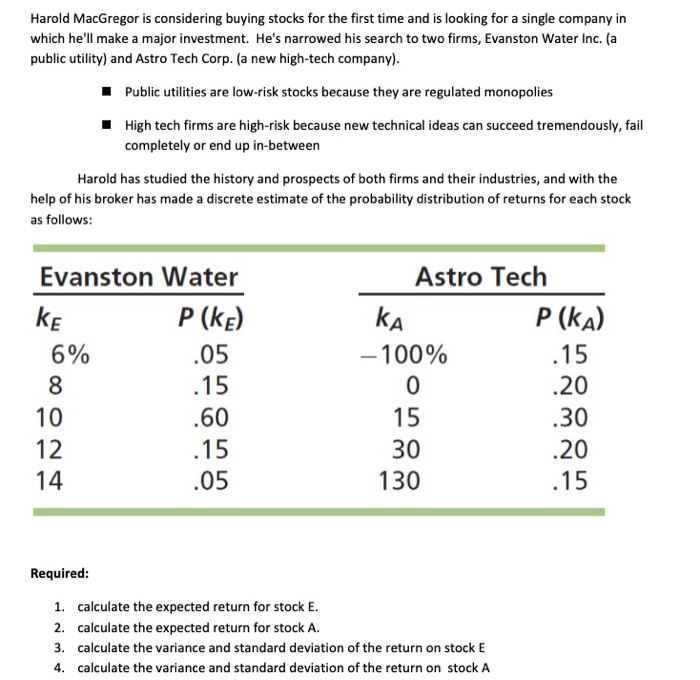

Harold MacGregor is considering buying stocks for the first time and is looking for a single company in which he'll make a major investment. He's narrowed his search to two firms, Evanston Water Inc. (a public utility) and Astro Tech Corp. (a new high-tech company). Public utilities are low-risk stocks because they are regulated monopolies High tech firms are high-risk because new technical ideas can succeed tremendously, fail completely or end up in-between Harold has studied the history and prospects of both firms and their industries, and with the help of his broker has made a discrete estimate of the probability distribution of returns for each stock as follows: Evanston Water ke P (KE) 6% .05 8 .15 10 .60 12 .15 .05 Astro Tech P (ka) - 100% .15 0 15 .30 30 .20 130 .15 .20 Required: 1. calculate the expected return for stock E. 2. calculate the expected return for stock A. 3. calculate the variance and standard deviation of the return on stock E 4. calculate the variance and standard deviation of the return on stock A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts