Question: Harry McCall operates a roller skating center, McCall Rinks. He has just received the company's monthly bank statement at February 28 from Ridgeway National Bank,

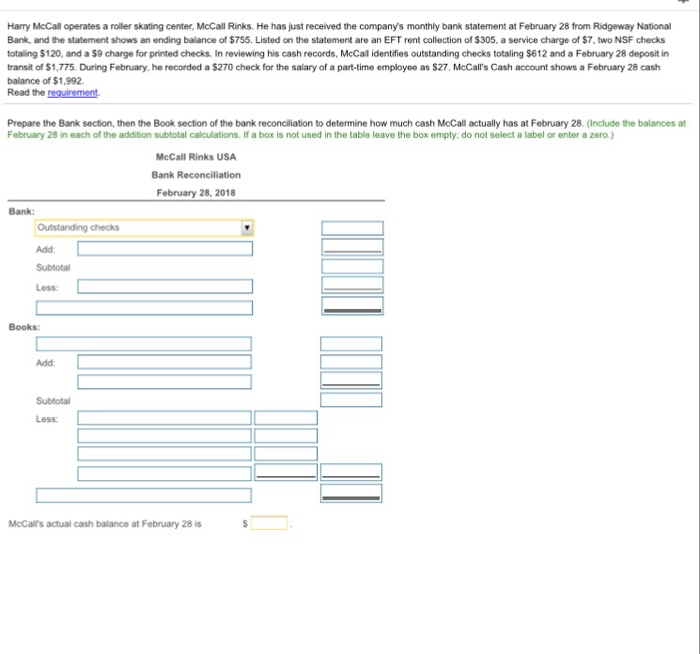

Harry McCall operates a roller skating center, McCall Rinks. He has just received the company's monthly bank statement at February 28 from Ridgeway National Bank, and the statement shows an ending balance of $755. Listed on the statement are an EFT rent collection of S305, a service charge of $7, two NSF checks totaling $120, and a $9 charge for printed checks. In reviewing his cash records, McCall identifies outstanding checks totaling $612 and a February 28 deposit in transit of $1,775. Dring February, he recorded a $270 check for the salary of a part-time employee as S27. McCall's Cash accont shows a February 28 cash balance of $1,992 Read the requirement Prepare the Bank section, then the Book section of the bank reconciliation to determine how much cash McCall actually has at February 28. (Include the balances at February 28 in each of the addition subtotal calculations. If a box is not used in the table leave the box empty, do not select a label or enter a zero.) McCall Rinks USA Bank Reconciliation February 28, 2018 Bank: Outstanding checks Add: Subtotal Less Books: Add Subtotal Less McCalrs actual cash balance at February 28 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts