Question: Harta Emas Bhd (HEB) has two potential projects, Project A and Project B. The forecasted cash flows and relevant information of the two projects

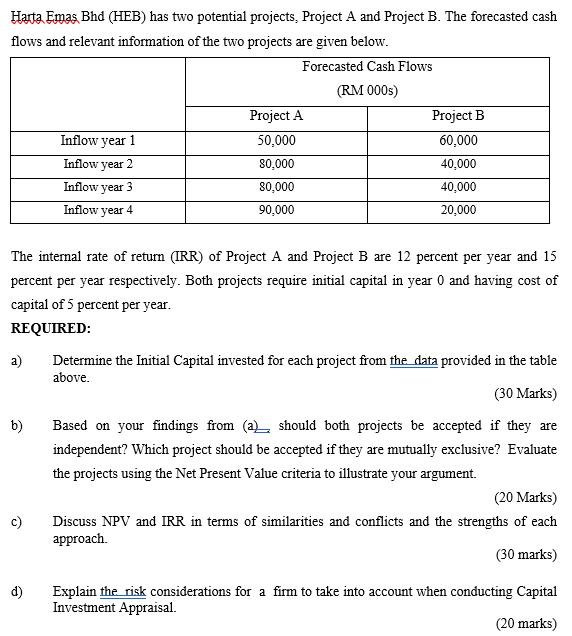

Harta Emas Bhd (HEB) has two potential projects, Project A and Project B. The forecasted cash flows and relevant information of the two projects are given below. Forecasted Cash Flows (RM 000s) a) b) The internal rate of return (IRR) of Project A and Project B are 12 percent per year and 15 percent per year respectively. Both projects require initial capital in year 0 and having cost of capital of 5 percent per year. REQUIRED: c) Inflow year 1 Inflow year 2 Inflow year 3 Inflow year 4 d) Project A 50,000 80,000 80,000 90,000 Project B 60,000 40,000 40,000 20,000 Determine the Initial Capital invested for each project from the data provided in the table above. (30 Marks) Based on your findings from (a) should both projects be accepted if they are independent? Which project should be accepted if they are mutually exclusive? Evaluate the projects using the Net Present Value criteria to illustrate your argument. (20 Marks) Discuss NPV and IRR in terms of similarities and conflicts and the strengths of each approach. (30 marks) Explain the risk considerations for a firm to take into account when conducting Capital Investment Appraisal. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts