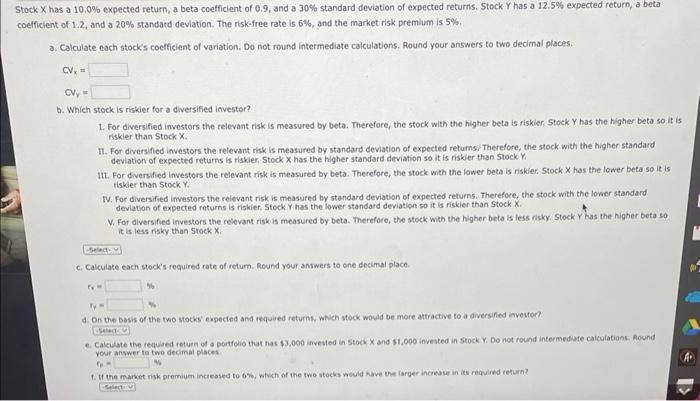

Question: has a 10,0% expected return, a beta coefficient of 0.9, and a 30% standard deviation of expected returns. Stock Y has a 12.5% expected return,

has a 10,0% expected return, a beta coefficient of 0.9, and a 30% standard deviation of expected returns. Stock Y has a 12.5% expected return, a beta int of 1.2, and a 20% standard deviation. The risk-free rate is 6%, and the market risk premlum is 5%. a. Calculate each stock's coefficient of variation. Do not round intermediate calculations. Round your answers to two decimal places. CVx=CV= b. Which stock is riskier for a diversified investor? 1. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is riskier. Stock Y has the higher beta so it riskler than Stock X. I1. For diversified investors the relevant risk is measured by standard deviation of expected retumsi Therefore, the stock with the higher standard deviation of expected returns is riskier. Stock X has the higher standart deviation so it is riskier than Stock Y. IIt. For diversfied investors the relevant risk is measured by beta. Therefore, the stock with the lower beta is riskier. Stock X has the lower beta so it is risker than Stock Y. IV. For diversified investors the relevant risk is measured by standard deviation of expected retums. Therefoce, the stock with the lower standard deviation of expected returns is riskier. Stock Y has the lower standord deviation so it is riskier than Stock X. V. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the Nigher beta is less risky. Stock y has the higher beta so it is less risky than 5 tock X. c, Calculate each stock's required rate of retum. Round your answers to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts