Question: Haskell Corp. is comparing two different capital structures. Plan I would result in 16,000 shares of stock and $100,000 in debt. Plan II would result

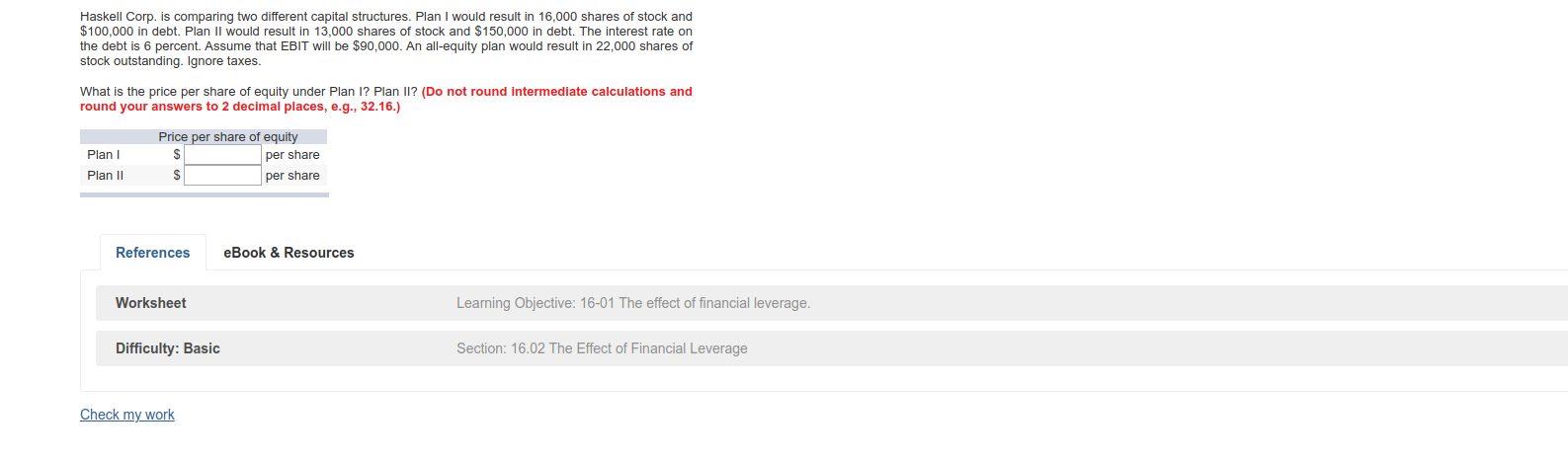

Haskell Corp. is comparing two different capital structures. Plan I would result in 16,000 shares of stock and $100,000 in debt. Plan II would result in 13,000 shares of stock and $150,000 in debt. The interest rate on the debt is 6 percent. Assume that EBIT will be $90,000. An all-equity plan would result in 22,000 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan Il? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Plan Plan II Price per share of equity per share per share References eBook & Resources Worksheet Learning Objective: 16-01 The effect of financial leverage. Difficulty: Basic Section: 16.02 The Effect of Financial Leverage Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts