Question: What does it mean that the expected impact of leverage is a high yield? How are buyouts and the market disposition and buyouts and leverage

What does it mean that the expected impact of leverage is a high yield? How are buyouts and the market disposition and buyouts and leverage correlated. We know that debt is profitable to a company. and that a company can benefit from tax shields. but how does it have any relation to an investor or management buying 100% of the firm from the shareholders and taking it private?

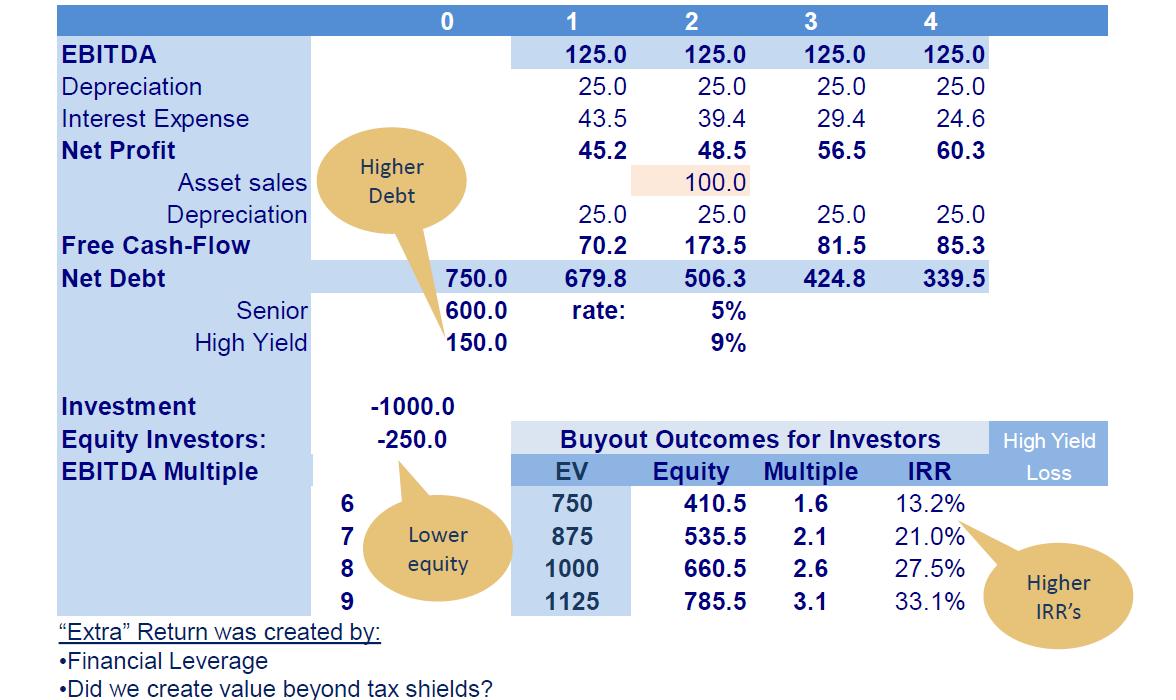

0 1 2 3 4 EBITDA Depreciation Interest Expense 125.0 125.0 125.0 125.0 25.0 25.0 25.0 25.0 43.5 39.4 29.4 24.6 Net Profit 45.2 48.5 56.5 60.3 Higher Asset sales 100.0 Debt Depreciation 25.0 25.0 25.0 25.0 Free Cash-Flow 70.2 173.5 81.5 85.3 Net Debt 750.0 679.8 506.3 424.8 339.5 Senior 600.0 rate: 5% High Yield 150.0 9% Investment -1000.0 Equity Investors: -250.0 Buyout Outcomes for Investors EBITDA Multiple EV Equity Multiple IRR High Yield Loss 6 750 410.5 1.6 13.2% 7 Lower 875 535.5 2.1 21.0% 8 equity 1000 660.5 2.6 27.5% Higher 9 1125 785.5 3.1 33.1% IRR's "Extra" Return was created by: Financial Leverage Did we create value beyond tax shields?

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

The text in the image says that the expected impact of leverage is a high yield This means that the company is using a lot of debt to finance itself which can be risky but also has the potential for a ... View full answer

Get step-by-step solutions from verified subject matter experts