Question: Have a hard time answering this question. HELP PLEASE. I'm not sure we should lay out $370.000 for that automated welding machine, said Jim president

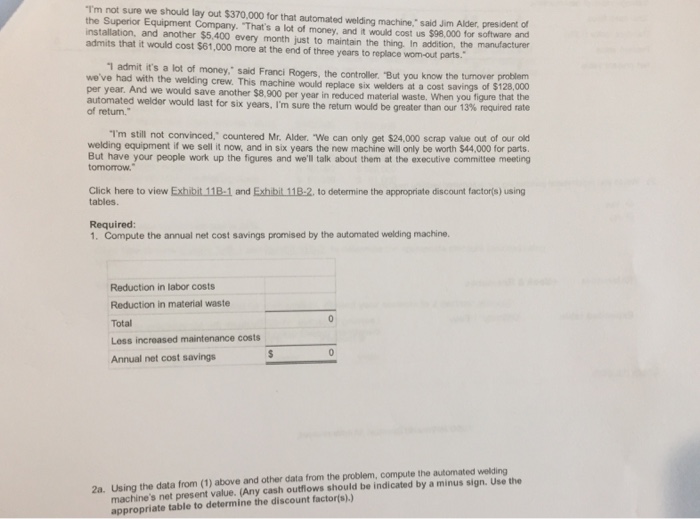

I'm not sure we should lay out $370.000 for that automated welding machine, said Jim president the Superior Equipment Company. "That's a lot of money, and it would cost us $98,000 for and installation, and another $5.400 every month just to maintain the thing. In addition, the manufacturer admits that it would cost $61,000 more at the end of three years to replace wom-out parts." "I admit it's a lot of money, " said Franci Rogers, controller. But you know the problem per had with the welding crew. This machine the six at a cost savings of $128,000 And would replace material waste. When you figure that the automated we would save another $8, 900 per year in reduced material waste. When you figure that the automated welder would last for six years, I'm sure the return would be greater than our 13% required rate of return." "I'm still not convinced, " countered Mr. Alder. only get $24.000 value out of our welding equipment if we sell it and in six years the new machine will only be worth for parts But have your people work up the figures and we'll talk about them at the executive committee meeting tomorrow." Click here to view Exhibit 11B-1 and Exhibit 11B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the annual net cost savings promised by the automated welding machine. 2a. Using the data from (1) above and other data from the problem, compute the automated welding machine's net present value. (Any cash outflows should be indicated by a minus sign. Use the appropriate table to determine the discount factor(s).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts