Question: have created a fair value and goodwill allocation schedule based on the data. Would it be a good decision to acquire Arizona Corp? Please use

have created a fair value and goodwill allocation schedule based on the data. Would it be a good decision to acquire Arizona Corp? Please use the fair value allocation and good will schedule below to answer the question.

Arizona Corp. had the following account balances at 12/1/19: Receivables: $96,000; Inventory: $240,000; Land: $720,000; Building: $600,000; Liabilities: $480,000; Common stock: $120,000; Additional paid-in capital: $120,000; Retained earnings, 12/1/19: $840,000; Revenues: $360,000; and Expenses: $264,000. Several of Arizona's accounts have fair values that differ from book value. The fair values are: Land $480,000; Building $720,000; Inventory $336,000; and Liabilities $396,000. Inglewood Inc. acquired all of the outstanding common shares of Arizona by issuing 20,000 shares of common stock having a $6 par value, but a $66 fair value. Stock issuance costs amounted to $12,000.

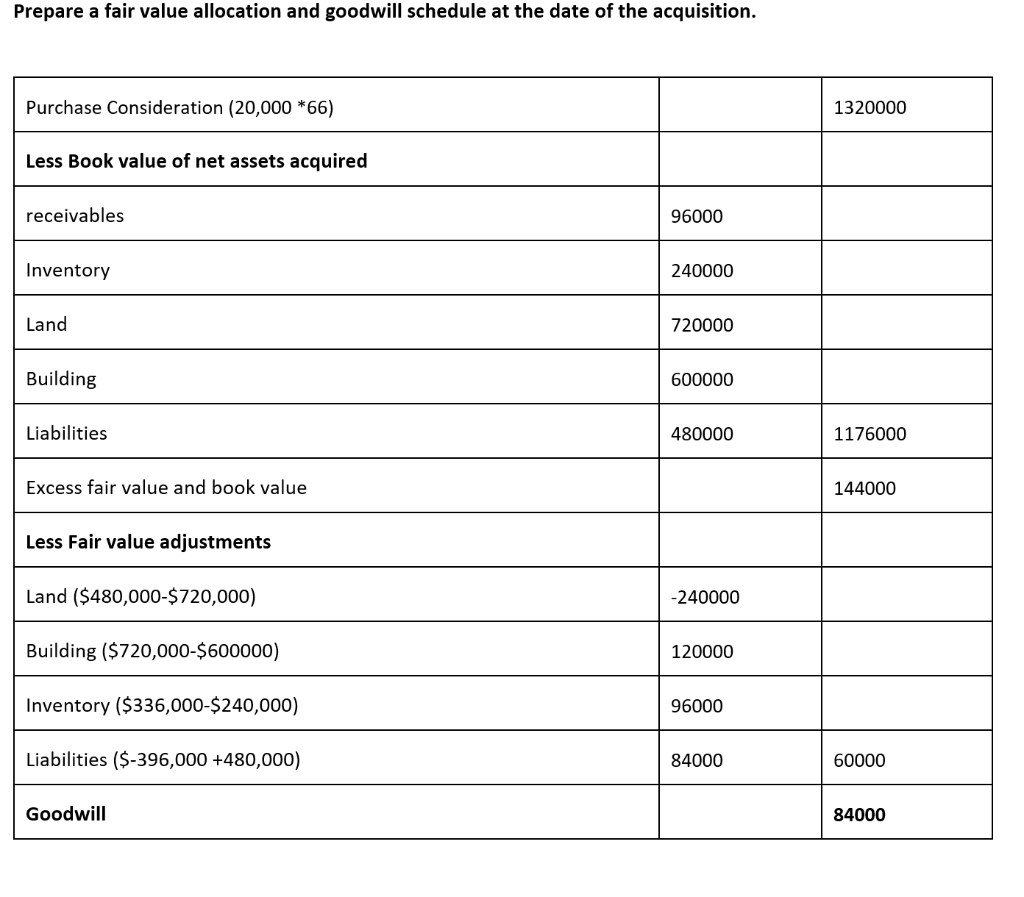

Prepare a fair value allocation and goodwill schedule at the date of the acquisition. Purchase Consideration (20,000 *66) 1320000 Less Book value of net assets acquired receivables 96000 Inventory 240000 Land 720000 Building 600000 Liabilities 480000 1176000 Excess fair value and book value 144000 Less Fair value adjustments Land ($480,000-$720,000) -240000 Building ($720,000-$600000) 120000 Inventory ($336,000-$240,000) 96000 Liabilities ($-396,000 +480,000) 84000 60000 Goodwill 84000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts