Question: have problem with the following question please summarise the equations in simple neat work 1.3. Assume now that the (random) returns to the risky asset

have problem with the following question please summarise the equations in simple neat work

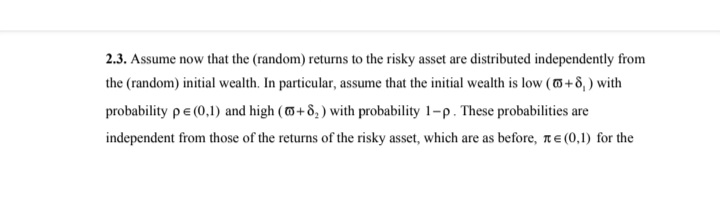

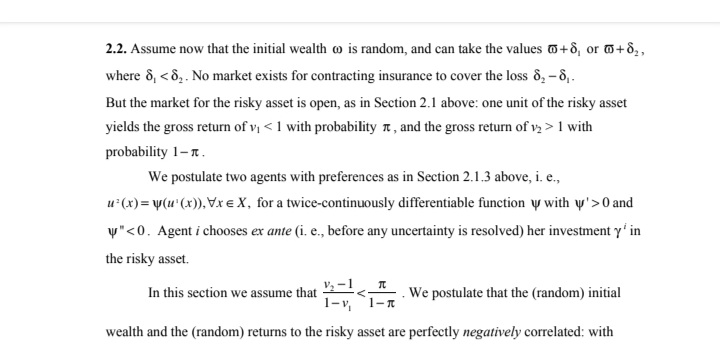

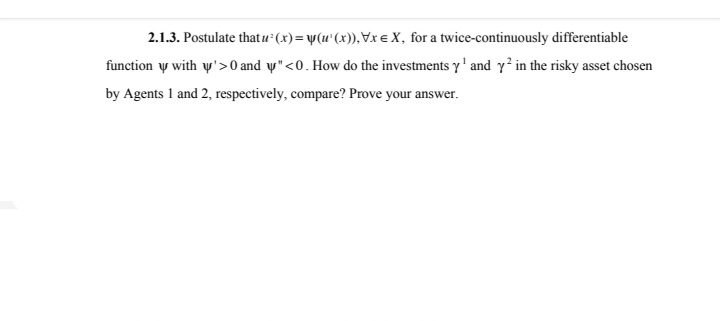

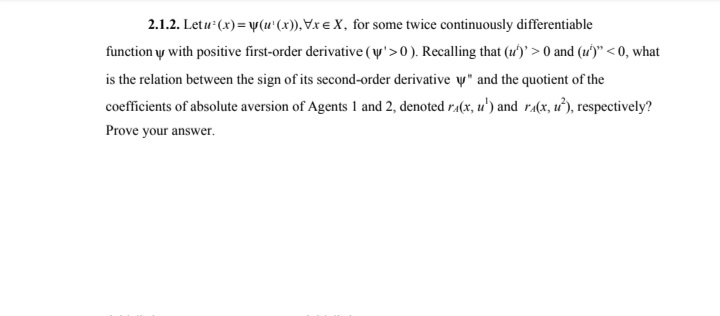

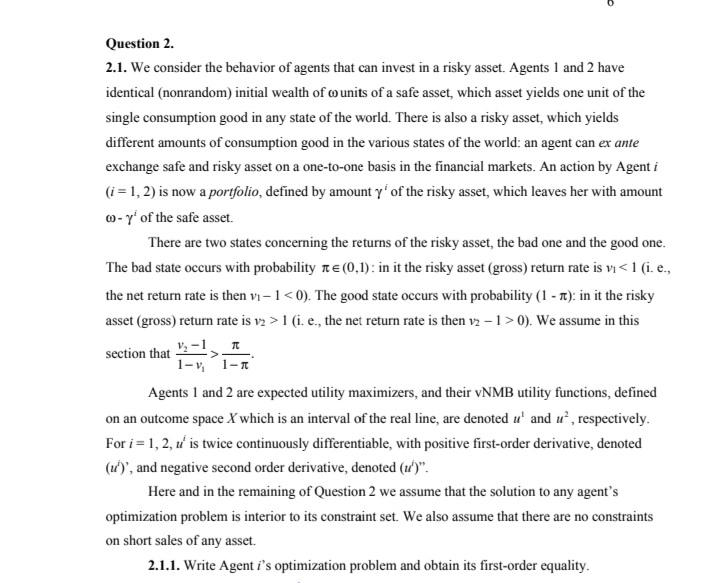

1.3. Assume now that the (random) returns to the risky asset are distributed independently from the {random} initial wealth. In particular. assume that the initial wealth is low I;I:l'.l+~I 1 with probability p 15 {Ill} and high {EH-5; } with probability lip . These probabilities are independent from those ofthe realms ofthe risky asset. which are as before. it E {I}. l] for the 2.2. Assume now that the initial wealth c is random, and can take the values 6+8, or @+6,, where 8, I with probability 1-n. We postulate two agents with preferences as in Section 2.1.3 above, i. e., u' (x) = w(u'(x)), Vxe X, for a twice-continuously differentiable function w with y'> 0 and " 0 and y" 0 ). Recalling that (u')' > 0 and (u')" 1 (i. e., the net return rate is then v2 - 1 > 0). We assume in this section that I - V Agents 1 and 2 are expected utility maximizers, and their vNMB utility functions, defined on an outcome space ) which is an interval of the real line, are denoted a' and a, respectively. For / = 1, 2, #' is twice continuously differentiable, with positive first-order derivative, denoted (u')', and negative second order derivative, denoted (u')". Here and in the remaining of Question 2 we assume that the solution to any agent's optimization problem is interior to its constraint set. We also assume that there are no constraints on short sales of any asset. 2.1.1. Write Agent /'s optimization problem and obtain its first-order equality

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts