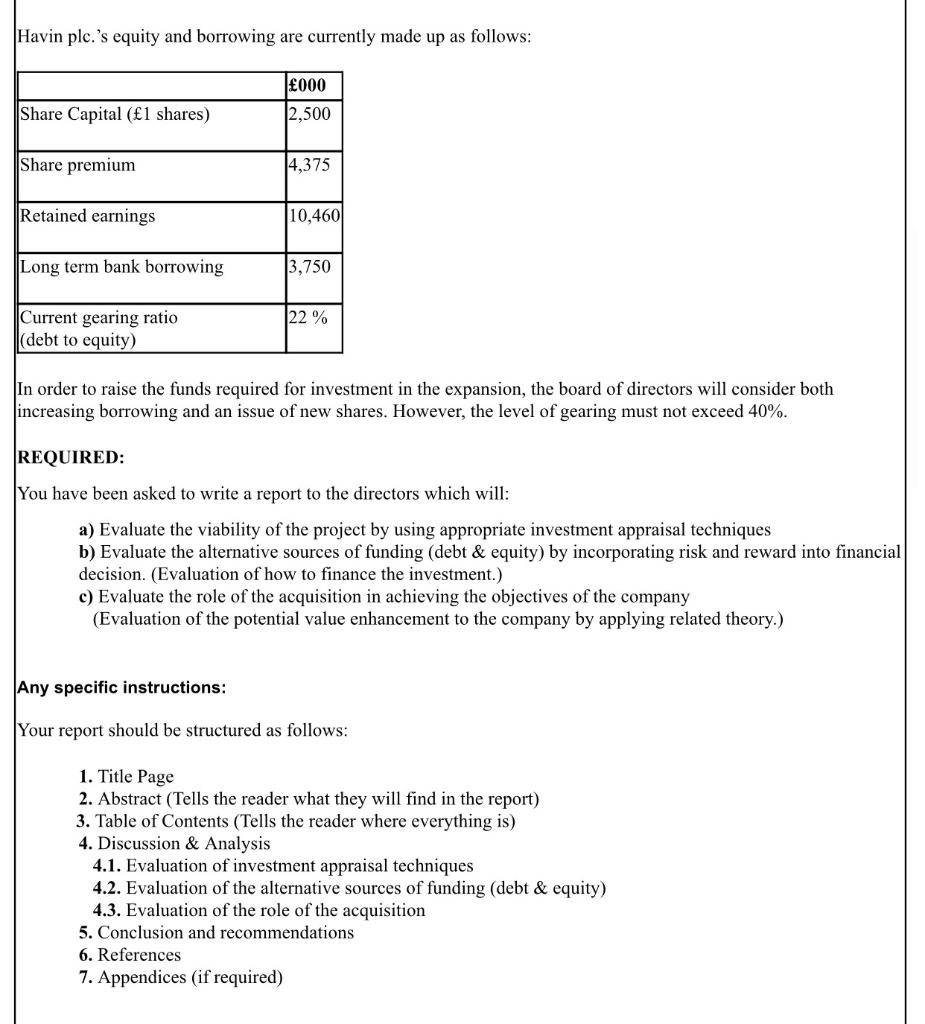

Question: Havin plc.'s equity and borrowing are currently made up as follows: 000 Share Capital (1 shares) 12,500 Share premium 4,375 Retained earnings 10,460 Long term

Havin plc.'s equity and borrowing are currently made up as follows: 000 Share Capital (1 shares) 12,500 Share premium 4,375 Retained earnings 10,460 Long term bank borrowing 3,750 22 % Current gearing ratio (debt to equity) In order to raise the funds required for investment in the expansion, the board of directors will consider both increasing borrowing and an issue of new shares. However, the level of gearing must not exceed 40%. REQUIRED: You have been asked to write a report to the directors which will: a) Evaluate the viability of the project by using appropriate investment appraisal techniques b) Evaluate the alternative sources of funding (debt & equity) by incorporating risk and reward into financial decision. (Evaluation of how to finance the investment.) c) Evaluate the role of the acquisition in achieving the objectives of the company (Evaluation of the potential value enhancement to the company by applying related theory.) Any specific instructions: Your report should be structured as follows: 1. Title Page 2. Abstract (Tells the reader what they will find in the report) 3. Table of Contents (Tells the reader where everything is) 4. Discussion & Analysis 4.1. Evaluation of investment appraisal techniques 4.2. Evaluation of the alternative sources of funding (debt & equity) 4.3. Evaluation of the role of the acquisition 5. Conclusion and recommendations 6. References 7. Appendices (if required) Havin plc.'s equity and borrowing are currently made up as follows: 000 Share Capital (1 shares) 12,500 Share premium 4,375 Retained earnings 10,460 Long term bank borrowing 3,750 22 % Current gearing ratio (debt to equity) In order to raise the funds required for investment in the expansion, the board of directors will consider both increasing borrowing and an issue of new shares. However, the level of gearing must not exceed 40%. REQUIRED: You have been asked to write a report to the directors which will: a) Evaluate the viability of the project by using appropriate investment appraisal techniques b) Evaluate the alternative sources of funding (debt & equity) by incorporating risk and reward into financial decision. (Evaluation of how to finance the investment.) c) Evaluate the role of the acquisition in achieving the objectives of the company (Evaluation of the potential value enhancement to the company by applying related theory.) Any specific instructions: Your report should be structured as follows: 1. Title Page 2. Abstract (Tells the reader what they will find in the report) 3. Table of Contents (Tells the reader where everything is) 4. Discussion & Analysis 4.1. Evaluation of investment appraisal techniques 4.2. Evaluation of the alternative sources of funding (debt & equity) 4.3. Evaluation of the role of the acquisition 5. Conclusion and recommendations 6. References 7. Appendices (if required)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts