Question: Having a bit of trouble understanding these problems. Any help and explanations would help greatly. Victor Mineli, the new controller of Carla Vista Co., has

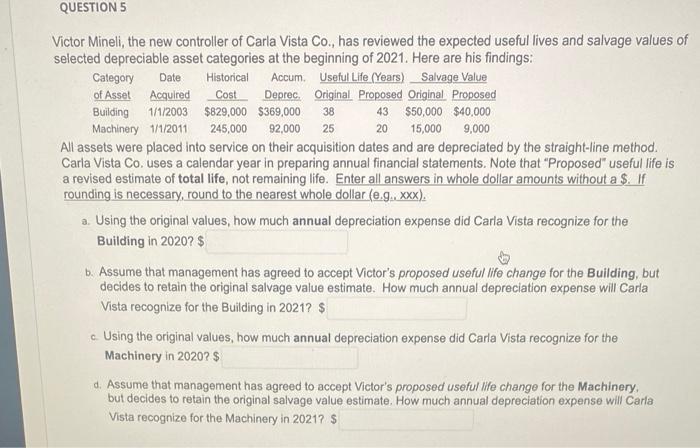

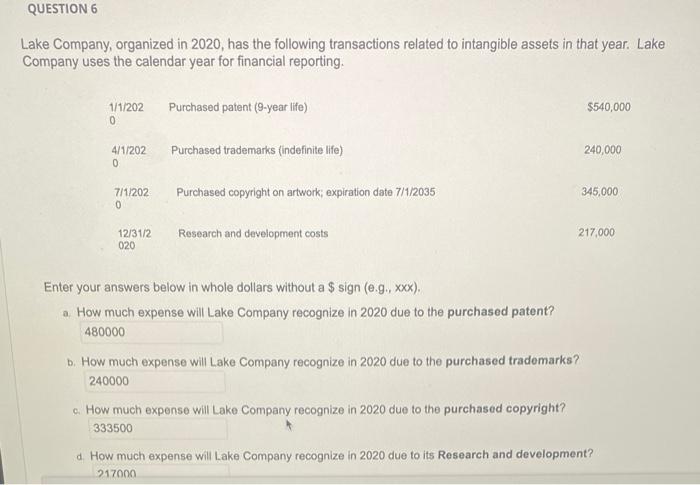

Victor Mineli, the new controller of Carla Vista Co., has reviewed the expected useful lives and salvage values of selected depreciable asset categories at the beginning of 2021 . Here are his findings: All assets were placed into service on their acquisition dates and are depreciated by the straight-line method. Carla Vista Co. uses a calendar year in preparing annual financial statements. Note that "Proposed" useful life is a revised estimate of total life, not remaining life. Enter all answers in whole dollar amounts without a \$. If rounding is necessary, round to the nearest whole dollar (.g,xxx), a. Using the original values, how much annual depreciation expense did Carla Vista recognize for the Building in 2020? \$ b. Assume that management has agreed to accept Victor's proposed useful life change for the Building, but decides to retain the original salvage value estimate. How much annual depreciation expense will Carla Vista recognize for the Building in 2021? \$ c. Using the original values, how much annual depreciation expense did Carla Vista recognize for the Machinery in 2020? \$ d. Assume that management has agreed to accept Victor's proposed useful life change for the Machinery. but decides to retain the original salvage value estimate. How much annual depreciation expense will Carla Vista recognize for the Machinery in 2021 ? \$ Lake Company, organized in 2020 , has the following transactions related to intangible assets in that year. Lake Company uses the calendar year for financial reporting. Enter your answers below in whole dollars without a $sign(e.g.,xxx). a. How much expense will Lake Company recognize in 2020 due to the purchased patent? b. How much expense will Lake Company recognize in 2020 due to the purchased trademarks? c. How much expense will Lake Company recognize in 2020 due to the purchased copyright? d. How much expense will Lake Company recognize in 2020 due to its Research and development

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts